Salary Calculator: See Your Take-Home Pay After Taxes (2025)

Whether you’re evaluating a new job offer or want to understand your current pay, knowing your take-home pay is essential for budgeting and financial planning. Use our 2025 Salary Calculator to convert your annual salary or hourly wage into a detailed paycheck breakdown, including federal, state, and FICA taxes.

Your Salary Breakdown

| Frequency | Unadjusted | Adjusted |

|---|

How to Use Our Salary Calculator

To see a detailed breakdown of your earnings, provide the information below. Our calculator uses the latest 2025 tax information for an accurate estimate.

Income: Enter your rate of pay. You can then select whether this figure represents an Annual Salary or an Hourly Wage.

Hours Per Week: If you entered an hourly wage, specify how many hours you typically work per week. The standard for a full-time job is 40 hours.

Pay Frequency: How often do you receive a paycheck? This affects your take-home amount per pay period.

Bi-weekly: Every two weeks (26 paychecks per year).

Semi-monthly: Twice per month, often on the 15th and last day (24 paychecks per year).

Weekly: Once per week (52 paychecks per year).

Monthly: Once per month (12 paychecks per year).

Filing Status & State: Select your tax filing status (e.g., Single, Married Filing Jointly) and the state where you work. This is crucial for an accurate income tax estimate.

Pre-Tax Deductions (Optional): To get the most precise take-home pay figure, enter any recurring pre-tax deductions. This includes contributions to a 401(k) or 403(b) plan, and premiums for health, dental, or vision insurance.

Understanding Your Results

Your results provide a complete picture of your earnings, from your total gross pay down to the net amount that lands in your bank account. The table breaks this down per year, per month, and per pay period.

| Breakdown | Per Year | Per Month | Per Pay Period |

| Gross Pay | $80,000 | $6,667 | $3,077 |

| — Deductions — | |||

| Federal Tax | $8,129 | $677 | $313 |

| State Tax | $0 | $0 | $0 |

| FICA (Soc. Sec. & Medicare) | $6,120 | $510 | $235 |

| Pre-Tax Deductions (e.g., 401k) | $4,800 | $400 | $185 |

| Total Deductions | $19,049 | $1,587 | $733 |

| Net Take-Home Pay | $60,951 | $5,079 | $2,344 |

(Note: The numbers above are for illustrative purposes for an individual in Texas making $80,000/year, filing single, and contributing 6% to a 401(k) on a bi-weekly schedule.)

Gross Pay: This is your headline salary or total earnings before any money is taken out for taxes or benefits.

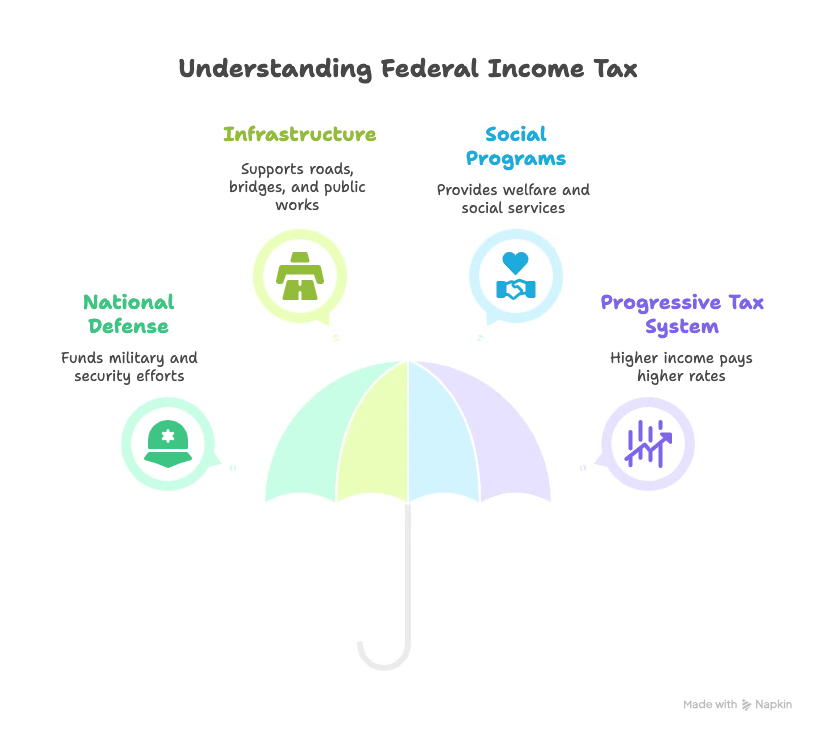

Federal Tax: The amount withheld for the U.S. federal government based on your income and filing status, using the official 2025 tax brackets.

State Tax: The amount withheld for your state government. This will be $0 if you work in a state with no income tax, like Texas or Florida.

FICA: This mandatory payroll tax is split into two parts: Social Security (6.2% on earnings up to the annual limit of

$177,900for 2025) and Medicare (1.45% on all your earnings). Your employer pays a matching amount.Pre-Tax Deductions: Money taken from your paycheck before income taxes are calculated. This includes contributions to retirement plans like a 401(k) and premiums for health insurance. These deductions lower your taxable income, saving you money.

Net Take-Home Pay: This is the bottom line—the actual amount of money you receive after all taxes and deductions. This is the number you should use for creating your budget.

Frequently Asked Questions

What’s the difference between bi-weekly and semi-monthly pay?

This is a common point of confusion. While they sound similar, they are different:

Bi-weekly: You are paid every two weeks. This results in 26 paychecks per year. Because there are slightly more than four weeks in a month, you will receive three paychecks during two months of the year.

Semi-monthly: You are paid twice per month (e.g., on the 1st and 15th). This results in a consistent 24 paychecks per year, with two paychecks every single month.

Knowing which you have is key for budgeting, especially for those “three-paycheck months” if you’re paid bi-weekly.

My new salary is $10,000 higher. Why isn’t my take-home pay $10,000 higher?

This is due to marginal tax rates. You don’t take home 100% of any raise. Every additional dollar you earn is taxed at your highest tax bracket.

Concrete Example: Imagine your current salary puts you in the 22% federal tax bracket. If you get a $10,000 raise, that extra income will be taxed at:

22% for federal income tax (

$2,200)7.65% for FICA taxes (

$765)Plus any applicable state and local taxes.

In this scenario, your $10,000 raise would only increase your take-home pay by roughly $7,035.

How can I increase my take-home pay?

While asking for a raise is the most direct way, you can also optimize your finances to keep more of your money:

Adjust Your W-4: If you consistently get a large tax refund, you are essentially giving the government an interest-free loan. You could adjust your W-4 tax withholding form with your employer to have less tax taken out of each paycheck. Be careful not to under-withhold, as this could lead to a tax bill.

Use Pre-Tax Accounts: Maximize contributions to accounts like a 401(k), Health Savings Account (HSA), or Flexible Spending Account (FSA). Every dollar you put in reduces your taxable income, lowering your tax bill and increasing your net pay over the long run.

Does this calculator account for overtime or bonuses?

This calculator is designed to provide a precise estimate based on your regular base salary or wage. It does not factor in irregular income like overtime or bonuses. This type of supplemental income is often subject to a flat federal withholding rate of 22% and is best analyzed separately from your recurring paycheck.

I work in Texas. Why is there no state tax in my results?

Our calculator correctly shows $0 for state income tax because Texas is one of nine states that do not levy a state income tax on wages. This is a significant financial benefit for residents. The other states with no income tax are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Washington, and Wyoming.

How much of my salary should I be saving?

A popular and effective guideline is the 50/30/20 budget rule:

50% for Needs: Allocate half of your take-home pay to essential living expenses like housing, utilities, groceries, and transportation.

30% for Wants: Allocate 30% to lifestyle choices like dining out, shopping, hobbies, and entertainment.

20% for Savings & Debt: Allocate at least 20% of your take-home pay toward financial goals. This includes building an emergency fund, paying down debt (beyond minimum payments), and investing for retirement.

Take the Next Step in Your Financial Journey

Now that you have a clear picture of your take-home pay, put that number to work.

See how your income supports your housing goals with our Home Affordability Calculator.

Determine if you’re saving enough for your long-term future with our Retirement Savings Calculator.

Create a detailed plan for your money using your net pay figure in our 50/30/20 Budget Calculator.

Creator