Roth IRA Calculator: See Your Tax-Free Retirement Growth

Planning for a tax-free retirement is one of the smartest financial moves you can make. Our Roth IRA Calculator helps you visualize how consistent contributions can grow over time, giving you a clear picture of your potential nest egg and the powerful benefit of tax-free earnings.

Roth IRA Advantage at Retirement

$0

Roth IRA vs. Taxable Account Growth

Roth IRA Balance

$0

Taxable Account Balance

$0

How to Use Our Roth IRA Calculator

To project your potential retirement savings, you’ll need just a few key pieces of information. Providing accurate numbers will give you the most realistic forecast.

Current Age: Enter your age today. This sets the starting point for your investment timeline.

Retirement Age: The age you plan to stop working and begin withdrawing funds. The time between your current age and retirement age is your investment horizon.

Current Roth IRA Balance: If you already have a Roth IRA, enter its current total value. If you’re just starting, leave this as 0.

Monthly Contribution: The amount of money you plan to invest in your Roth IRA each month. Consistency is a key driver of long-term growth.

Expected Annual Return: This is an estimate of the average yearly return on your investments. Historically, the stock market has averaged around 8-10% annually, but returns are not guaranteed. A conservative estimate of 6-7% is often used for planning.

Marginal Tax Rate (Optional): Enter your combined federal and state marginal tax rate. This field is used to show you the powerful advantage of a Roth IRA’s tax-free growth compared to a standard, taxable brokerage account.

Understanding Your Results

After you enter your information, the calculator will provide a primary number: your Total Value at Retirement. While this final balance is exciting, the real power is in understanding its components. Our results chart breaks this down for you.

| Metric | Description | Example Value |

| Total Value | The projected total balance of your Roth IRA at your chosen retirement age. | $1,056,345 |

| Total Contributions | The sum of all the money you personally put into the account over the years. This is your “principal.” | $168,000 |

| Tax-Free Growth | The total earnings your investments have generated. This is the money your money made, thanks to compound interest. | $888,345 |

The most important takeaway is this: With a Roth IRA, all of the Tax-Free Growth can be withdrawn in retirement completely, 100% tax-free. In the example above, that’s $888,345 you can access without paying a single dollar in federal income tax, assuming you meet the qualifying withdrawal conditions.

This is visually represented in the results pie chart, which shows how much of your final nest egg is from your own contributions versus how much is pure, tax-free investment growth.

Frequently Asked Questions

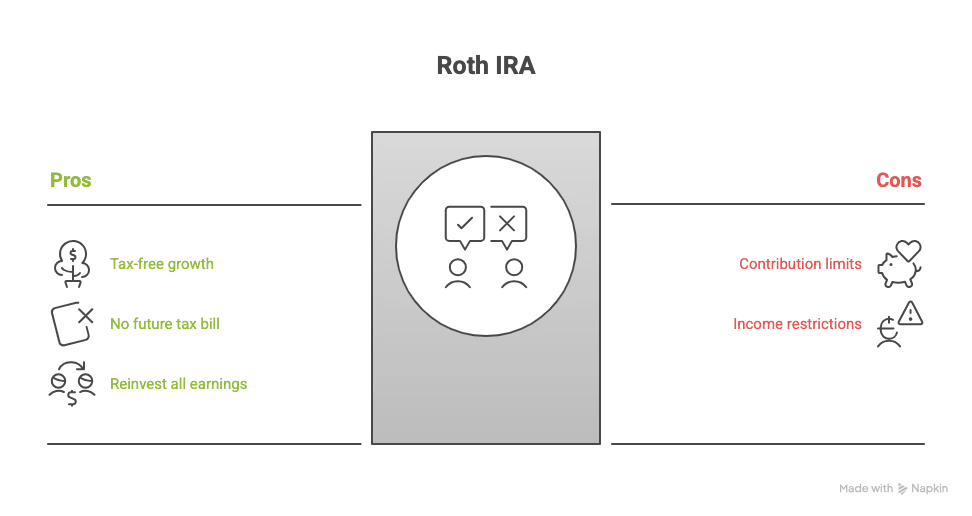

What’s the real difference between a Roth IRA and a Traditional IRA?

The primary difference boils down to when you pay taxes. This single distinction affects contributions and withdrawals.

| Feature | Roth IRA | Traditional IRA |

| Taxes on Contributions | You contribute with after-tax dollars. There is no upfront tax deduction. | You may be able to deduct contributions from your taxes, lowering your current income. |

| Taxes on Withdrawals | Qualified withdrawals in retirement (age 59½+) are 100% tax-free. | Withdrawals in retirement are taxed as ordinary income. |

| Who It’s Good For | People who expect to be in the same or a higher tax bracket in retirement. | People who expect to be in a lower tax bracket in retirement. |

| Income Limits | Higher earners may be prohibited from contributing directly. | There are no income limits to contribute, but income limits the tax-deductibility. |

In short: Roth = Pay taxes now, no taxes later. Traditional = Maybe get a tax break now, pay taxes later.

How much can I contribute to a Roth IRA?

The IRS sets annual limits on IRA contributions. For 2025, the maximum contribution amount is $7,000 for individuals under age 50.

If you are age 50 or older, you are eligible for a “catch-up contribution,” allowing you to invest an additional $1,000, for a total of $8,000 for the year. These limits are subject to change by the IRS, so it’s always good to check the official IRS website for the current year’s limits.

Am I eligible to contribute to a Roth IRA?

Eligibility to contribute to a Roth IRA is based on your Modified Adjusted Gross Income (MAGI). The IRS sets income phase-out ranges that determine if you can contribute the full amount, a reduced amount, or nothing at all.

Example for 2025 (Note: These are illustrative figures; check the IRS for official numbers):

Single Filers: You can contribute the full amount if your MAGI is below

$148,000. The ability to contribute is phased out between$148,000and$163,000. You cannot contribute if your MAGI is over$163,000.Married Filing Jointly: You can contribute the full amount if your MAGI is below

$220,000. The phase-out range is between$220,000and$245,000. You cannot contribute if your MAGI is over$245,000.

If your income is too high, you may be able to use a strategy known as a “Backdoor Roth IRA.”

What happens if I need my money before retirement?

This is one of the most powerful and misunderstood benefits of a Roth IRA. You can withdraw your direct contributions (the money you put in) at any time, for any reason, without paying taxes or penalties.

Concrete Example: Let’s say over five years you contribute $30,000 to your Roth IRA. Your investments do well, and the account grows to $40,000. The $10,000 is your earnings. If you face a major unexpected expense, you can withdraw up to your original $30,000 in contributions with no strings attached. The $10,000 in earnings, however, must remain in the account until retirement age (59½) to avoid potential taxes and penalties.

Should I prioritize a Roth IRA or my company’s 401(k)?

For most people, the optimal strategy follows a simple hierarchy:

Contribute to your 401(k) up to the company match. If your employer offers a 4% match, contribute at least 4% of your salary. This is a 100% return on your money and is the best investment you can make. Do not skip this step.

Fully fund your Roth IRA. After securing the full 401(k) match, aim to contribute the maximum annual amount to your Roth IRA (

$7,000in 2025). This gives you tax diversification in retirement.Go back to your 401(k). If you have more money to invest after maxing out your Roth IRA, increase your 401(k) contributions until you hit the federal maximum (

$24,000in 2025).

What should I invest in inside my Roth IRA?

A Roth IRA is just the account—a “tax-advantaged bucket.” You still need to choose investments to put inside it. For most people, simple, low-cost, and diversified funds are the best choice.

Target-Date Funds: A fund that automatically adjusts its investment mix from aggressive to more conservative as you get closer to your target retirement date (e.g., a “2060 Fund”). This is a great “set it and forget it” option.

Low-Cost Index Funds: These funds aim to mirror a market index, like the S&P 500 (the 500 largest U.S. companies) or a Total Stock Market index. They offer broad diversification at a very low cost.

Now that you’ve projected your Roth IRA’s growth, see how it fits into your complete retirement picture with our comprehensive Retirement Calculator.

Comparing your investment options? See how these results stack up against a pre-tax account with our 401(k) Calculator.

Creator