RMD Calculator for 2025: Required Minimum Distribution Tool

Calculating your annual Required Minimum Distribution (RMD) is a crucial step to avoid significant tax penalties in retirement. Use our simple RMD calculator to determine the exact amount the IRS requires you to withdraw from your retirement accounts this year.

Your RMD for 2024

$0

Based on a distribution period of 0 years.

Future RMD & Balance Projection

RMD Schedule

| Year | Age | RMD Amount | Year-End Balance |

|---|

How to Use Our RMD Calculator

To find your required withdrawal amount, you only need a couple of pieces of information. It is critical to use the correct figures as specified by IRS rules.

Date of Birth: Enter your full date of birth. This is used to determine your age for the current year and find the correct life expectancy factor from the official IRS tables.

Account Balance (as of Dec. 31, 2024): This is the most important input. The IRS requires that your RMD for the current year (2025) be calculated based on your account’s total value at the close of the previous year. Do not use the current value.

Spouse’s Date of Birth (Optional): Only enter this if your spouse is the sole beneficiary of your IRA and is more than 10 years younger than you. In this specific situation, a different IRS table is used which may result in a lower RMD.

Understanding Your Results

The calculator provides you with two key pieces of information that determine your mandatory withdrawal for the year.

Your Required Minimum Distribution (RMD) for 2025: This is the total dollar amount you must withdraw from your retirement account(s) before the deadline to satisfy the IRS requirement.

Distribution Period (Life Expectancy Factor): This is the number from the IRS Uniform Lifetime Table that corresponds to your age. Your RMD is calculated by dividing your prior year-end account balance by this factor.

What To Do Next

Meet the Deadline: You must withdraw your full RMD amount by December 31, 2025.

Special First-Year Rule: If this is your very first RMD, you have an extended deadline until April 1, 2026. However, if you delay, you will have to take two RMDs in 2026 (one for 2025 and one for 2026), which could result in a significantly higher tax bill for that year.

Understand the Penalty: If you fail to withdraw the full RMD amount by the deadline, the IRS can impose a penalty of 25% on the portion you failed to withdraw. This penalty can be reduced to 10% if you correct the mistake in a timely manner.

Frequently Asked Questions

What exactly is a Required Minimum Distribution (RMD)?

An RMD is the minimum amount of money you must withdraw each year from most types of retirement accounts after you reach a certain age. The U.S. government provides significant tax advantages for accounts like Traditional IRAs and 401(k)s to encourage retirement savings. The RMD is the government’s way of ensuring it eventually collects income tax on this tax-deferred growth.

When do I have to start taking RMDs?

The starting age for RMDs was updated by the SECURE 2.0 Act. Your starting age depends on the year you were born.

Born 1951-1959: You must begin taking RMDs at age 73.

Born 1960 or later: You must begin taking RMDs at age 75.

Your first RMD is for the year you reach that age.

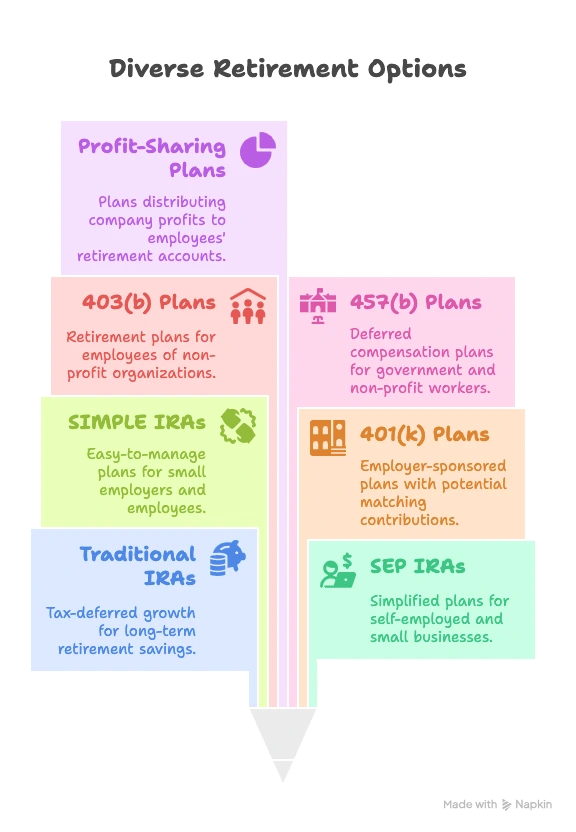

Which of my accounts are subject to RMDs?

It is critical to know which accounts have RMDs and which do not.

| Accounts That HAVE RMDs | Accounts That DO NOT Have RMDs |

| Traditional IRAs | Roth IRAs (for the original owner) |

| SEP IRAs | Roth 401(k)s (though may be required if rolled into Roth IRA) |

| SIMPLE IRAs | Standard (taxable) Brokerage Accounts |

| 401(k) plans | Bank Savings/Checking Accounts & CDs |

| 403(b) plans | Health Savings Accounts (HSAs) |

| 457(b) plans | |

| Profit-sharing plans |

How is the RMD formula calculated?

The formula is simple. Our calculator does it for you automatically, but the underlying math is:

The “Life Expectancy Factor” is found in the IRS Uniform Lifetime Table. The calculator looks up your age in the table to find the correct factor and then performs the division.

If I have multiple IRAs, can I take the total RMD from just one?

Yes, for IRAs this is a common and helpful strategy.

Concrete Example: You have two Traditional IRAs.

IRA #1 has a calculated RMD of

$10,000.IRA #2 has a calculated RMD of

$5,000.

Your total RMD for the year is $15,000. You can satisfy this by withdrawing the full $15,000 from IRA #1, from IRA #2, or any combination from both that adds up to $15,000.

Important: This rule does not apply to 401(k)s or other workplace plans. An RMD for a 401(k) must be taken from that specific 401(k) account. The same applies to 403(b)s.

What is the penalty if I miss my RMD?

The penalty for a missed RMD used to be 50%, but it has been reduced. It is now a 25% excise tax on the amount that was not withdrawn on time. If you realize your mistake and correct it quickly (generally within two years), the penalty can be reduced to 10%. To request a waiver of the penalty, you must withdraw the shortfall and file IRS Form 5329.

Can I avoid paying taxes on my RMD?

Generally, no. RMDs from pre-tax accounts are taxed as ordinary income. However, there is a powerful strategy called a Qualified Charitable Distribution (QCD).

A QCD allows individuals aged 70½ and older to donate up to $105,000 (the 2025 inflation-adjusted limit) directly from their IRA to a qualified charity. The amount donated via a QCD counts toward your RMD for the year but is excluded from your taxable income. This is the only way to satisfy your RMD requirement without adding to your taxable income.

Planning for your heirs? Understand how they will need to take distributions with our Inherited IRA / Beneficiary RMD Calculator.

Once you take your RMD, you might consider how it fits into your overall spending plan. Use our Retirement Withdrawal Calculator to model a sustainable income stream.

If your RMD is from a Traditional IRA, compare the long-term tax implications of different account types with our Traditional vs. Roth IRA Calculator.

Creator