Rental Property Calculator: Analyze Cash Flow, Cap Rate & ROI

Analyzing a potential rental property is the most critical step in making a smart real estate investment. Our comprehensive Rental Property Calculator helps you move beyond the listing price to forecast cash flow, return on investment (ROI), and overall profitability in just a few steps.

Monthly Cash Flow

$0

Cap Rate

0.00%

Cash on Cash ROI

0.00%

Monthly Costs Breakdown

Equity & Loan Balance Projection (10 Years)

How to Use Our Rental Property Calculator

To get an accurate picture of your potential investment, you’ll need to input details about the purchase, loan, income, and expenses. The more precise your numbers, the more reliable your results will be.

Purchase & Loan Information

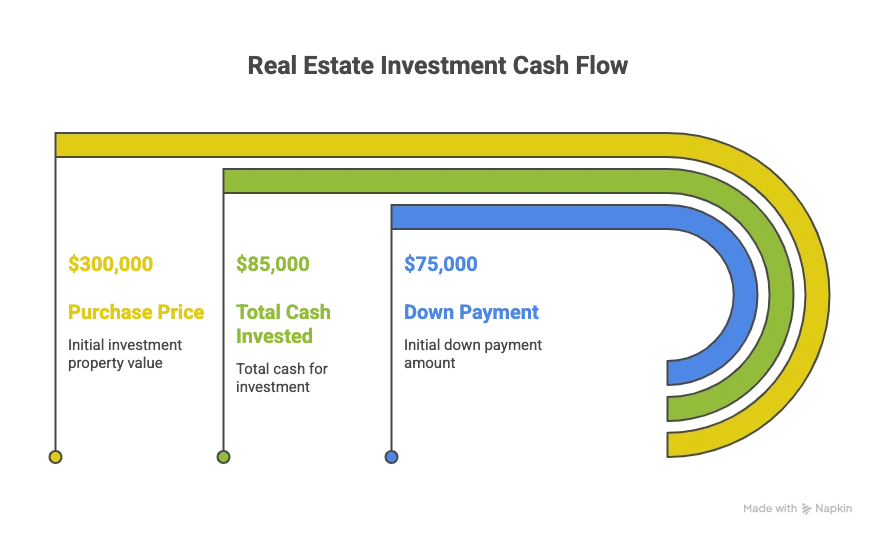

Purchase Price: Enter the full purchase price of the property.

Down Payment: The amount of cash you’re paying upfront. You can enter this as a flat dollar amount or as a percentage of the Purchase Price (e.g., $50,000 or 20%).

Loan Term: The length of your mortgage in years. The most common terms for investment properties are 30 and 15 years.

Interest Rate (%): The annual interest rate for your mortgage. Note that interest rates for investment properties are often slightly higher than for primary residences.

Monthly Income

Gross Monthly Rent: Enter the total rent you expect to collect each month. Research comparable rental listings (“comps”) in the area to get a realistic number.

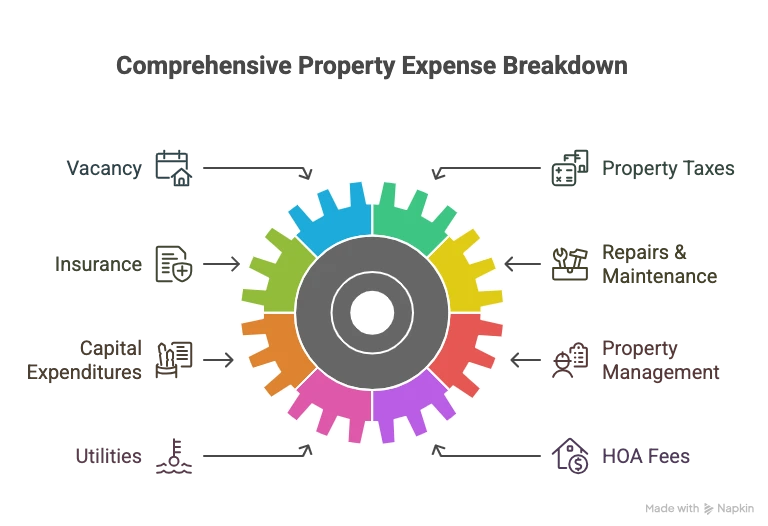

Monthly Operating Expenses

Property Taxes: The monthly property tax payment. You can usually find the annual tax amount on the real estate listing and divide by 12.

Home Insurance: The monthly cost of landlord insurance, which is different from a standard homeowner’s policy. Get a quote from an insurance agent for an accurate estimate.

Repairs & Maintenance: A crucial and often overlooked expense. A good rule of thumb is to budget 5-10% of the gross monthly rent for ongoing repairs (e.g., leaky faucet, broken appliance).

Vacancy Rate (%): No property is occupied 100% of the time. A standard vacancy rate to budget for is 5-10%, which accounts for the time it takes to find a new tenant. Enter 5 for 5%, for example.

Property Management Fees (%): If you plan to hire a property manager, they typically charge 8-12% of the monthly rent. If you plan to self-manage, you can enter 0, but be sure to account for your own time and effort.

HOA Fees: If the property is in a Homeowners Association, enter the monthly fee here.

Other Expenses: Use this field for any other recurring monthly costs, such as landscaping, pest control, or specific utilities you plan to cover for the tenant.

Understanding Your Results

The calculator will provide several key metrics to help you evaluate the investment. The most important result is your net cash flow, but understanding the return on investment is what separates savvy investors.

Here’s a breakdown of how your results are calculated:

| Metric | Calculation | What It Means |

| Total Monthly Income | Gross Monthly Rent | The total rent collected before any expenses. |

| Total Monthly Expenses | Taxes + Insurance + Repairs + Vacancy + Management + HOA + Other | The total cost to operate the property each month. |

| Net Operating Income (NOI) | Total Monthly Income – Total Monthly Expenses | Your property’s profit before factoring in the mortgage. |

| Monthly Mortgage (P&I) | Calculated from your loan inputs | The principal and interest portion of your loan payment. |

| Total Monthly Cash Flow | NOI – Monthly Mortgage Payment | The profit (or loss) left in your pocket each month. |

| Annual Cash Flow | Monthly Cash Flow x 12 | Your total profit (or loss) for the year. |

Beyond simple cash flow, there are two industry-standard metrics for measuring a rental property’s performance:

What is Cash-on-Cash (CoC) Return?

Cash-on-Cash Return is arguably the most important metric for real estate investors. It measures the annual cash flow you receive relative to the actual amount of cash you invested. This tells you how hard your money is working for you.

The formula is:

Where ‘Total Cash Invested’ includes your down payment, closing costs, and any initial repair costs. A higher CoC Return is better.

What is Capitalization Rate (Cap Rate)?

Cap Rate measures a property’s profitability without considering the mortgage. It helps you compare the performance of different properties regardless of how they are financed. Think of it as the return you would get if you bought the property with all cash.

The formula is:

Where ‘Annual NOI’ is your annual rental income minus your annual operating expenses.

Frequently Asked Questions

What is a “good” cash-on-cash return?

While there’s no single “correct” answer, many real estate investors aim for a cash-on-cash return of 8% to 12% or higher. However, the “right” number depends heavily on your goals, the market, and the risk level. A lower-return property in a rapidly appreciating neighborhood might be a great investment, while a high-return property in a declining area could be a bad one.

How do I accurately estimate repair costs and vacancy?

For a quick estimate, some investors use the “50% Rule,” which states that operating expenses (everything except the mortgage) will be about 50% of the gross rent over time.

For a more precise approach, use these guidelines:

Repairs & Maintenance: Budget 1% of the property’s purchase price annually. For a $300,000 home, that’s $3,000 per year, or $250 per month. Alternatively, use 5-10% of the monthly rent.

Vacancy: Research the average vacancy rate in your specific city or zip code. If you can’t find it, using 5% (about 18 days a year) is a conservative starting point for a desirable area.

What is the 1% Rule and is it still useful?

The “1% Rule” is a quick screening guideline that suggests a property should rent for at least 1% of its purchase price each month. For example, a $250,000 property should rent for at least $2,500/month.

Is it useful? Yes, but only as an initial filter to quickly discard properties that are unlikely to cash flow. It is not a substitute for a full analysis like the one our calculator provides, as it completely ignores the wide variation in property taxes, insurance, and other expenses.

What’s the difference between Cap Rate and Cash-on-Cash Return?

The key difference is financing. Cap Rate ignores the mortgage, while Cash-on-Cash Return is based on it.

Concrete Example: Imagine a $400,000 property with an Annual NOI of $24,000.

Cap Rate: The Cap Rate is always the same, regardless of financing.

Cap Rate=$400,000$24,000=6%Cash-on-Cash Return (Scenario A: 25% Down Payment): You invest $100,000 cash. After your mortgage payment, your annual cash flow is $8,000.

CoC Return=$100,000$8,000=8%Cash-on-Cash Return (Scenario B: 50% Down Payment): You invest $200,000 cash. Your mortgage is smaller, so your annual cash flow is now $14,000.

CoC Return=$200,000$14,000=7%

In this case, using more leverage (a smaller down payment) resulted in a higher Cash-on-Cash return, even though the property and its Cap Rate remained identical.

Should I hire a property manager?

This depends on your distance from the property, the time you’re willing to commit, and your desire to deal with tenants and repairs.

Hire a Manager if: You live far away, value your time more than the fee, or don’t want the hassle of finding tenants, collecting rent, and handling late-night repair calls. The cost is typically 8-12% of the rent.

Self-Manage if: You live nearby, have the time and skills to handle maintenance and tenant issues, and want to maximize your monthly cash flow.

What about closing costs?

Closing costs are the fees paid to finalize a real estate transaction, typically ranging from 2% to 5% of the purchase price. They include fees for the appraisal, title insurance, loan origination, and more. While our calculator focuses on the ongoing monthly profitability of the property, remember to factor closing costs into your Total Cash Invested when you evaluate your true Cash-on-Cash Return.

Now that you’ve analyzed this property’s potential, take the next step:

Drill down into your loan with our Amortization Schedule Calculator to see how much principal you’ll pay down over time.

Assess how this new mortgage will impact your overall financial health with our Debt-to-Income (DTI) Ratio Calculator.