Mortgage Calculator with PMI, Property Tax & Homeowners Insurance

Estimating your potential monthly mortgage payment is a critical first step in the home-buying process. Our comprehensive mortgage calculator below will help you get a clear picture of your total monthly housing cost, including principal, interest, taxes, and insurance.

20%

Advanced Options

Your Monthly Payment

$0.00

Summary

Amortization Schedule

| Year | Principal Paid | Interest Paid | Ending Balance |

|---|

How to Use Our Mortgage Calculator

To get the most accurate estimate, you’ll need a few key pieces of information. Here’s a simple breakdown of each input field.

Home Price: Enter the full purchase price of the home you plan to buy.

Down Payment: This is the amount of cash you are paying upfront toward the home’s purchase price. You can enter this as a specific dollar amount (e.g.,

$50,000) or as a percentage of the Home Price (e.g.,20%).Loan Term (in years): This is the length of time you have to repay the loan. The most common loan terms in the U.S. are 30 years and 15 years.

Interest Rate (%): The annual interest rate for the loan. If a lender has given you a quote, use that rate. Otherwise, you can use today’s average rates for an initial estimate to see how payments might look.

Property Tax (%): The annual tax paid to your local government based on your home’s value. This is typically expressed as a percentage of the home price (e.g.,

1.25%). You can often find accurate local rates on county websites or in real estate listings. Our calculator divides this annual cost by 12 to show you the monthly amount.Homeowners Insurance: The annual premium for insuring your home against fire, theft, and other damages. If you don’t have a specific quote, you can estimate this cost. A common rule of thumb is around

$1,200a year for a$300,000home, but this varies widely by location and coverage.PMI (Private Mortgage Insurance): This insurance protects the lender if you stop making payments. It’s usually required if your down payment is less than 20% of the home’s price. The annual cost is typically between

0.5%and2%of your loan amount. Our calculator will automatically apply an estimate if your down payment is below20%.

Understanding Your Results

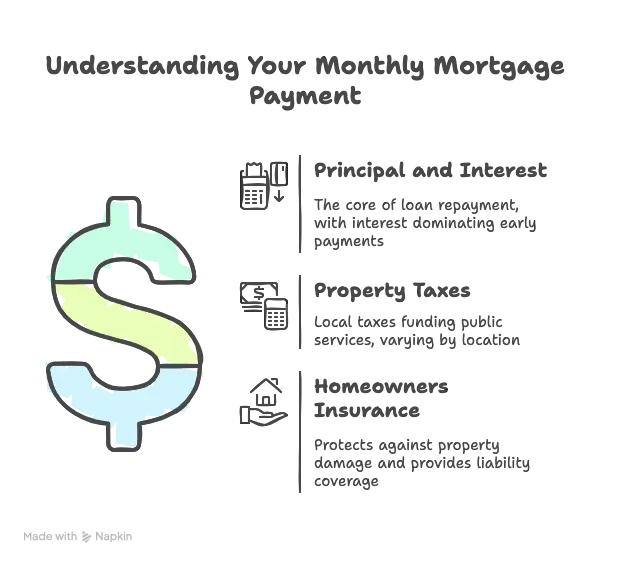

The final number our calculator displays is your estimated total monthly mortgage payment. This is often called “PITI” because it’s made up of four main components:

Principal: This is the portion of your payment that goes directly toward paying down the amount you borrowed. In the early years of your loan, the principal portion of your payment is small, but it increases over time.

Interest: This is the cost you pay the lender to borrow the money. In the early years, interest makes up the largest portion of your monthly payment.

Taxes: This represents one-twelfth (

1/12) of your property’s annual tax bill. Your lender usually collects this amount each month and keeps it in a special savings account called an escrow account. They then pay your tax bill for you once or twice a year.Insurance: This is one-twelfth (

1/12) of your annual homeowners insurance premium. Like property taxes, this is typically collected monthly and paid from your escrow account by the lender.

If your down payment is less than 20%, your total payment will also include Private Mortgage Insurance (PMI), which we explain in more detail below.

Frequently Asked Questions

What is PMI and how can I avoid it?

Private Mortgage Insurance (PMI) is a type of insurance that protects your lender—not you—in case you default on your loan. Lenders almost always require PMI when a homebuyer makes a down payment of less than 20%. To avoid paying for PMI, the simplest solution is to make a down payment of 20% or more. If you can’t, you can typically request to have PMI removed once you’ve paid down your mortgage balance to 80% of the home’s original appraised value. By law, lenders must automatically terminate PMI when your balance drops to 78%.

Should I choose a 15-year or 30-year mortgage?

This decision involves a trade-off between your monthly payment and the total interest you’ll pay.

30-Year Mortgage: Offers a lower monthly payment, providing more flexibility in your monthly budget. However, you will pay significantly more in total interest over the life of the loan.

15-Year Mortgage: Has a much higher monthly payment. The benefits are that you build equity much faster, pay off your home in half the time, and save a massive amount of money on interest.

For example, on a $300,000 loan at 6.5% interest, you would pay over $200,000 less in interest with a 15-year term compared to a 30-year term.

How much house can I realistically afford?

A common guideline used by lenders is the 28/36 rule.

The 28% Rule: Your total housing costs (PITI) should not exceed

28%of your gross monthly income (your income before taxes).The 36% Rule: Your total debt payments (including your new mortgage payment, car loans, student loans, and credit card payments) should not exceed

36%of your gross monthly income.

For example, if your gross monthly income is $7,000, your total housing payment should not exceed $1,960 (28% of $7,000).

While lenders may approve you for more, sticking to this rule helps ensure you can live comfortably without being “house poor.”

What’s the difference between interest rate and APR?

This is a crucial distinction when comparing loan offers.

Interest Rate: This is simply the percentage cost of borrowing the principal loan amount.

APR (Annual Percentage Rate): This is a broader measure of the loan’s cost. It includes the interest rate plus other lender fees, such as loan origination fees and closing costs.

Because it includes more costs, the APR is almost always higher than the interest rate and is the best number to use for an apples-to-apples comparison between different lenders.

How can I get a lower monthly mortgage payment?

There are several ways to reduce your estimated monthly payment:

Make a larger down payment: A larger down payment reduces your loan amount, which lowers your principal and interest payment. If it’s

20%or more, you also eliminate PMI.Improve your credit score: A higher credit score signals to lenders that you are a lower-risk borrower, which qualifies you for a lower interest rate.

Choose a longer loan term: A 30-year term has lower payments than a 15-year term, but you’ll pay more interest in the long run.

Shop for a lower interest rate: Rates can vary significantly between lenders. Get quotes from at least three different lenders.

Shop for homeowners insurance: Don’t just accept the first quote. Compare insurance providers to find a lower premium.

Are closing costs included in this calculation?

No. This calculator estimates your ongoing monthly payment. Closing costs are a separate, one-time set of fees you pay when you finalize the mortgage. These fees cover services like the appraisal, title search, and loan origination. Expect closing costs to be between 2% and 5% of your total loan amount.

Next Steps & Other Tools

Now that you’ve estimated your monthly payment, see how it impacts your overall financial health.

Use our Debt-to-Income Ratio Calculator to see if your new mortgage payment fits within the recommended 28/36 rule.

Wondering how much you could save over the long run? See the impact of making extra payments with our Mortgage Payoff Calculator.

See how making a larger down payment could impact your finances with our Down Payment Calculator.

Creator