IRA Calculator: Traditional vs. Roth Comparison

Choosing the right Individual Retirement Arrangement (IRA) is a cornerstone of smart retirement planning. This calculator is designed to help you compare a Traditional and Roth IRA side-by-side, projecting your potential growth and, most importantly, your estimated after-tax wealth in retirement.

Calculating...

Adjust the inputs to see which account performs best.

After-Tax Growth Comparison

Traditional IRA

$0

(After-Tax)

Roth IRA

$0

(After-Tax)

Taxable Account

$0

(After-Tax)

How to Use Our IRA Calculator

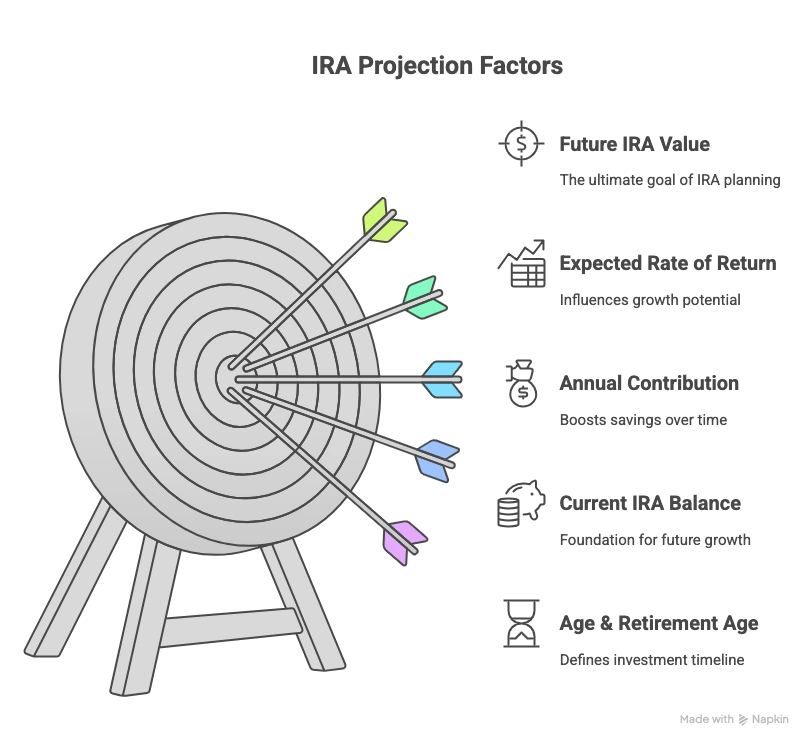

This tool helps you model different scenarios to see which type of IRA might be more beneficial for you. Enter the following information to compare your options.

-

Current Age: Your age today. This sets the beginning of your savings timeline.

-

Retirement Age: The age you expect to stop working. The longer the timeline, the more significant the impact of compound growth.

-

Current IRA Balance: The total amount you already have saved in IRAs. If you are just getting started, you can leave this at 0.

-

Monthly Contribution: The amount you plan to invest each month.

-

Expected Annual Return: An estimate of your investment’s average yearly performance. While the S&P 500 has historically returned around 8-10%, using a more conservative 6-7% is common for long-term planning.

-

Your Current Marginal Tax Rate (%): Enter your combined federal and state tax rate. This is the rate you pay on your next dollar of income, which is used to calculate the potential tax deduction for a Traditional IRA contribution.

-

Expected Retirement Tax Rate (%): Your best estimate of your combined tax rate in retirement. This is the most critical variable for comparing a Traditional vs. Roth IRA, as it determines the tax bite on your Traditional IRA withdrawals.

Understanding Your Results

The most valuable output of this calculator is the direct comparison of how a Traditional and Roth IRA perform based on your tax assumptions. The final “Net Take-Home Value” is the number that matters most.

Here is a breakdown of what each line in the results table means:

| Result Metric | Traditional IRA Calculation & Meaning | Roth IRA Calculation & Meaning |

| Total Value at Retirement | The full, pre-tax balance of your account at retirement. This is the large number before any taxes are taken out. | The full balance of your account at retirement. |

| Upfront Tax Savings (Today) | The immediate tax deduction you receive from contributing. Calculated as (Total Contributions) x (Your Current Tax Rate). |

$0. There is no upfront tax deduction for Roth contributions. |

| Taxes Owed in Retirement | The estimated taxes you’ll pay on withdrawals. Calculated as (Total Value at Retirement) x (Expected Retirement Tax Rate). |

$0. Qualified withdrawals are completely tax-free. |

| Net Take-Home Value | The Bottom Line. This is your (Total Value at Retirement) minus (Taxes Owed in Retirement). It’s your real, spendable money. |

The Bottom Line. Since there are no taxes in retirement, this is equal to your (Total Value at Retirement). |

How to Interpret the Results: After running the calculation, look at the Net Take-Home Value. If this number is higher for the Roth IRA, it suggests paying taxes now may be more beneficial. If it’s higher for the Traditional IRA, taking the tax deduction today could be the more advantageous path.

Frequently Asked Questions

Which is better for me: Roth or Traditional IRA?

The best choice depends almost entirely on your current income versus your expected income (and tax rate) in retirement.

-

Choose a Traditional IRA if: You believe your tax rate will be lower in retirement than it is today. The upfront tax deduction is more valuable now, and you’ll pay taxes at that lower rate when you withdraw the money. This is often appealing to people in their peak earning years.

-

Choose a Roth IRA if: You believe your tax rate will be higher (or the same) in retirement. It’s better to pay taxes on your contributions now at your current, lower rate and let all the growth and withdrawals be tax-free later. This is often attractive to those early in their careers.

Remember, income limits may restrict your ability to deduct Traditional IRA contributions or contribute to a Roth IRA directly.

Can I have both a Roth and a Traditional IRA?

Yes, you absolutely can. Many people have both to diversify their tax situation in retirement. However, you must adhere to a single, combined annual contribution limit set by the IRS.

Concrete Example: For 2025, the total IRA contribution limit is $7,000 (for those under 50). You could contribute $4,000 to your Roth IRA and $3,000 to your Traditional IRA in the same year. You could not, however, contribute $7,000 to each.

What is an IRA rollover and should I do one?

An IRA rollover is the process of moving funds from an old employer-sponsored retirement plan (like a 401(k), 403(b), or TSP) into an IRA that you control.

You should consider a rollover if you’ve left a job for three main reasons:

-

More Investment Choices: Most 401(k) plans have a limited menu of funds. An IRA gives you nearly unlimited investment options.

-

Potentially Lower Fees: Many IRAs offer access to funds with lower expense ratios than those in employer plans.

-

Consolidation: It simplifies your financial life by keeping all your retirement funds in one place.

What are the key withdrawal rules I need to know?

Withdrawal rules are a critical component of IRAs. Here’s a simple breakdown:

| Rule | Traditional IRA | Roth IRA |

| Withdrawals Before Age 59½ | Subject to ordinary income tax and a 10% penalty (with some exceptions). | Contributions can be withdrawn tax-free and penalty-free at any time. Earnings are subject to tax/penalty. |

| Withdrawals After Age 59½ | Taxed as ordinary income. | 100% Tax-Free (assuming the account is at least 5 years old). |

| Required Minimum Distributions (RMDs) | You must begin taking withdrawals starting at age 73. | No RMDs for the original account owner. You can let the money grow for your entire life if you wish. |

Can I lose money in an IRA?

Yes. It is crucial to understand that an IRA is an investment account, not a bank savings account. The value of the stocks, bonds, or funds within your IRA will fluctuate with the market. While there is a risk of loss, especially in the short term, investing for the long term (10+ years) has historically been an effective way to build wealth.

How do I open an IRA?

Opening an IRA is a straightforward process that takes less than 30 minutes.

-

Choose a Provider: Select a reputable brokerage firm. Major providers include Vanguard, Fidelity, and Charles Schwab.

-

Select Account Type: Decide between a Traditional or Roth IRA based on your research.

-

Provide Information: You will need to provide your personal information, such as your Social Security number and employment details.

-

Fund the Account: Transfer money into your new IRA via an electronic bank transfer or by initiating a rollover.

-

Choose Your Investments: Once the money is in the account, you must select the investments (e.g., index funds, target-date funds) to purchase.

Want to dive deeper into the power of tax-free growth? Explore the specific benefits with our dedicated Roth IRA Calculator.

Considering moving funds from an old 401(k)? Our IRA Rollover Calculator can help you understand the process and benefits.

To see how your retirement savings fit into your complete financial picture, use our Net Worth and Budgeting Calculator.

Creator