House Affordability Calculator Based on Income and Debt (DTI)

Determining how much house you can realistically afford is the most important first step in the home-buying journey. Use our house affordability calculator to get a solid estimate based on your income, debts, and down payment, so you can search for homes with confidence.

Affordable Home Price

$0

Estimated Monthly Payment

How to Use Our House Affordability Calculator

To calculate your home buying budget, provide a few key details about your overall financial picture.

Gross Annual Income: Your total household income for one year, before any taxes or deductions are taken out.

Monthly Debts: Add up all your recurring monthly debt payments. This includes minimum credit card payments, car loans, student loans, personal loans, and child support. Do not include your current rent payment, as this will be replaced by your mortgage payment.

Down Payment: The total amount of cash you have saved to pay upfront for the home. A larger down payment reduces the loan amount and increases your buying power.

Loan Term: The length of the mortgage you plan to get. A 30-year term is the most common and will result in a higher affordable home price compared to a 15-year term.

Interest Rate (%): The estimated annual interest rate you expect on your mortgage. You can check current average mortgage rates online to get a good estimate for today, July 22, 2025.

Estimated Property Taxes (%): The annual property tax rate for the area where you plan to buy, expressed as a percentage of the home’s value (e.g.,

1.25%). Rates in Texas, for example, can be higher than the national average, which impacts affordability. A higher tax rate will lower your home buying budget.Estimated Homeowners Insurance: The estimated annual cost to insure your home (e.g.,

$1,800).

Understanding Your Results: The 28/36 Rule

The calculator provides you with an estimated affordable home price based on standard lending guidelines. This isn’t an arbitrary number; it’s calculated using a principle called the Debt-to-Income (DTI) ratio. Most lenders follow the “28/36 rule” to determine how much they are willing to lend you.

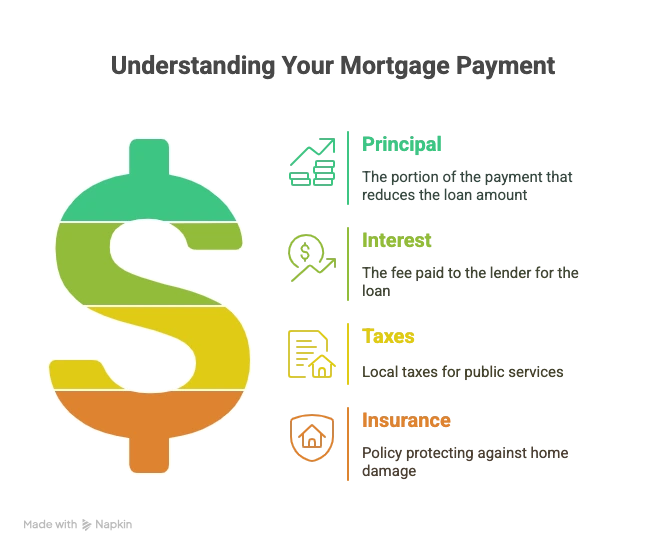

The 28% Rule (Front-End Ratio): Your total future monthly housing payment (PITI: Principal, Interest, Taxes, Insurance) should be no more than

28%of your gross monthly income.The 36% Rule (Back-End Ratio): Your total monthly debt payments (your new PITI payment + all other existing debts like car loans and credit cards) should be no more than

36%of your gross monthly income.

Our calculator determines your maximum affordable home price by ensuring you do not exceed either of these limits.

Example Breakdown

Let’s see how it works for someone with a $90,000 annual income ($7,500/month), $500 in monthly debts, and a $40,000 down payment.

| Metric | Calculation | Result |

| Gross Monthly Income | $90,000 / 12 | $7,500 |

| Max Housing Payment (28% Rule) | $7,500 * 0.28 | $2,100 |

| Max Total Debt (36% Rule) | $7,500 * 0.36 | $2,700 |

| Room for Housing Payment | $2,700 - $500 (existing debt) | $2,200 |

| Limiting Monthly Payment | The lower of the two results | $2,100 |

| Affordable Home Price | (Loan amount based on $2,100/mo) + Down Payment | ~$365,000 |

This calculation assumes a 30-year loan at 6.5% interest, 1.25% property tax, and $1,500/year insurance. Your results will vary.

Frequently Asked Questions

How can I increase my home affordability?

You can increase your home-buying budget in several ways:

Pay Down Debt: Reducing your monthly debt obligations (like paying off a car loan or credit card) frees up more of your income for a mortgage payment, directly increasing what you can afford under the 36% rule.

Increase Your Down Payment: A larger down payment means you have to borrow less, which directly increases the home price you can afford.

Improve Your Credit Score: A higher credit score doesn’t directly change the 28/36 rule, but it qualifies you for a lower interest rate. A lower rate means a lower monthly payment, allowing you to afford a more expensive home.

Increase Your Income: A higher income increases the dollar amount available under both the 28% and 36% rules.

Is the affordable home price the same as what I’ll be pre-approved for?

Not necessarily. This calculator gives you a conservative and responsible estimate based on standard guidelines. A lender’s pre-approval is a conditional commitment to lend you a specific amount. Some lenders may use higher DTI thresholds (e.g., up to 43% or even 50%) and pre-approve you for a larger loan. However, just because a bank is willing to lend you more money doesn’t mean you should take it. Exceeding the 28/36 rule can put significant strain on your budget and leave you “house poor.”

How does my credit score affect how much house I can afford?

Your credit score has a significant, indirect impact on affordability. A better credit score gets you a lower mortgage interest rate. Concrete Example: On a $300,000 loan, the monthly principal & interest payment at 7.0% interest is $1,996. At 6.0% interest, that payment drops to $1,799. That $197 difference each month means you can afford a more expensive house while keeping the same payment, or simply enjoy a lower payment and more breathing room in your budget.

What other costs should I budget for besides the down payment?

This is a critical question. The purchase price is not the only major expense. You must also budget for:

Closing Costs: These are fees for services required to close the loan, such as the appraisal, title search, and lender fees. Budget for

2%to5%of the total loan amount.Moving Expenses: The cost of hiring movers or renting a truck.

Initial Home Repairs & Furnishings: Your new home will likely need some personal touches, repairs, or new furniture.

Building an Emergency Fund: It’s wise to have 3-6 months of living expenses saved for unexpected events, especially after a large purchase like a home.

Should I spend the maximum amount the calculator says I can afford?

This is a personal decision, but as a rule of thumb, it’s wise not to. The affordability calculation is a ceiling, not a target. Before you commit to the maximum amount, consider your other financial goals and lifestyle choices. Do you want to travel, save aggressively for retirement, or have hobbies? Leaving some room in your budget each month provides financial flexibility and reduces stress.

How does a down payment of less than 20% affect affordability?

Making a down payment of less than 20% impacts affordability in two main ways. First, you have a larger loan amount. Second, you will almost certainly be required to pay Private Mortgage Insurance (PMI). PMI is an extra monthly fee that protects the lender, and it is included in your DTI calculation. This extra fee acts like any other debt, reducing the amount of money available for your actual mortgage payment and thereby lowering your total affordable home price.

Next Steps & Other Tools

Now that you have a target home price, you can plan your next steps.

Use our Mortgage Calculator with PITI to see a detailed breakdown of the monthly payments on a specific home.

Want to see how your loan balance gets paid down over time? Explore the numbers with our [Loan Amortization Calculator].

Learn about the pros and cons of different loan options in our guide: 15-Year vs. 30-Year Mortgages: Which Is Right for You?

Creator