Auto Loan Calculator with Trade-In, Tax & Fees

Figuring out your potential monthly car payment is the most important step in the car-buying process. It determines how much car you can truly afford. Use our comprehensive auto loan calculator below to estimate your monthly payment and see the total cost of your loan before you ever step into a dealership.

Results

Monthly Payment

Amortization Schedule

| Month | Interest | Principal | Balance |

|---|

Auto Loan Details

Enter your loan details to see your payment schedule and total cost.

How to Use Our Auto Loan Calculator

To get the most accurate estimate, you’ll need a few key pieces of information. Here’s a simple breakdown of each input field.

Vehicle Price: Enter the sticker price or the agreed-upon purchase price of the vehicle. Do not include your down payment or trade-in value here.

Down Payment: This is the amount of cash you are paying upfront towards the car’s price. A larger down payment reduces your loan amount, which lowers your monthly payment and the total interest you’ll pay.

Trade-in Value: If you are trading in your current vehicle, enter the value the dealership is offering you. This amount is subtracted from the vehicle price, further reducing your total loan amount.

Sales Tax (%): Enter the sales tax rate for your state and locality. In Houston, TX, for example, the rate is 8.25%. This tax is typically calculated on the vehicle price after the trade-in value is deducted and added to your total loan amount.

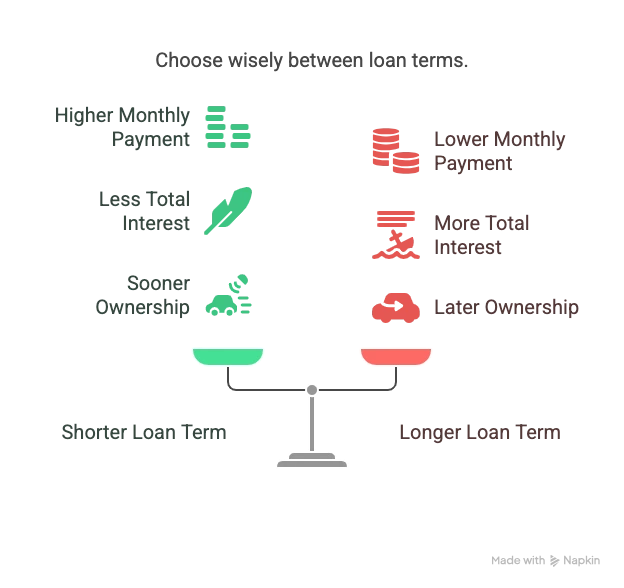

Loan Term (Months): This is the length of your loan. Common terms are 36, 48, 60, 72, or even 84 months. A shorter term means higher monthly payments but less interest paid overall. A longer term results in lower monthly payments but a significantly higher total interest cost.

Interest Rate (APR): Enter the Annual Percentage Rate (APR) you expect to receive. This is the annual cost of borrowing money, including interest and some fees, expressed as a percentage. Your credit score is the single biggest factor that determines your APR.

Understanding Your Results

The calculator provides more than just a monthly payment. It shows you the true cost of financing a vehicle over time. Here’s what your results mean.

Estimated Monthly Payment: This is the amount you will likely pay your lender each month for the duration of the loan term. It’s a combination of paying back the amount you borrowed (principal) and the cost of borrowing (interest).

Total Amount Financed: This is the final loan amount after all adjustments. The formula is:

Total Financed=(Vehicle Price−Down Payment−Trade-in Value)+Sales TaxTotal Interest Paid: This is a crucial number to watch. It represents the total amount of money you will pay just in interest over the entire life of the loan. A lower number is always better.

Total Cost of Loan: This is the sum of the total amount you financed plus all the interest you will pay. It reveals the true, all-in cost of your vehicle.

To visualize how your loan is paid off, lenders use an amortization schedule. Here is a simplified example of how the first few payments on a $25,000 loan might look. Notice how more of your payment goes to interest at the beginning.

| Payment https://www.google.com/search?q=%23 | Monthly Payment | Principal Paid | Interest Paid | Remaining Balance |

| 1 | $483.32 | $379.15 | $104.17 | $24,620.85 |

| 2 | $483.32 | $379.15 | $102.59 | $24,240.87 |

| 3 | $483.32 | $381.56 | $101.76 | $23,859.31 |

Frequently Asked Questions

What is a good APR for a car loan in 2025?

A “good” APR depends heavily on your credit score and current market conditions set by the Federal Reserve. A higher credit score signals to lenders that you are a lower-risk borrower, earning you a lower interest rate.

Here’s a general guide to what you might expect based on your credit score for a new car loan:

| Credit Score Range | Borrower Tier | Estimated APR |

| 781 – 850 | Super Prime | 4.5% – 6.0% |

| 661 – 780 | Prime | 6.0% – 8.5% |

| 601 – 660 | Nonprime | 8.5% – 13.0% |

| 501 – 600 | Subprime | 13.0% – 19.0% |

| 300 – 500 | Deep Subprime | 19.0%+ |

Note: These are estimates. To get your actual rate, it’s best to get pre-approved for a loan from a bank or credit union before visiting the dealership.

Should I choose a 60-month or a 72-month loan?

While a 72-month (or even 84-month) loan offers a lower monthly payment, it almost always costs you more in the long run. The longer you finance, the more interest you pay.

Concrete Example: Let’s say you’re financing $30,000 at a 7.0% APR.

60-Month (5-Year) Loan:

Monthly Payment:

$594.06Total Interest Paid:

$5,643.60

72-Month (6-Year) Loan:

Monthly Payment:

$511.45Total Interest Paid:

$6,824.40

Choosing the 72-month term lowers your payment by about $83 per month, but it costs you an extra $1,180.80 in interest. As a general rule, choose the shortest loan term with a monthly payment you can comfortably afford.

How does a down payment affect my auto loan?

A down payment directly benefits you in three major ways:

Lowers Your Monthly Payment: Since you’re borrowing less money, your payments will be smaller.

Reduces Total Interest: Borrowing less means you pay interest on a smaller principal amount, saving you money over the life of the loan.

Prevents Being “Upside Down”: A new car depreciates (loses value) the moment you drive it off the lot. A significant down payment (e.g., 20%) helps ensure your loan balance doesn’t exceed the car’s value, which is known as being “upside down” or having negative equity.

Should I get pre-approved for a loan before going to the dealership?

Yes, absolutely. Getting pre-approved from a bank, credit union, or online lender before you shop gives you a powerful advantage. It tells you exactly how much you can afford and gives you a benchmark interest rate. You can then ask the dealership’s finance department to beat that rate. If they can’t, you can confidently use your pre-approved loan.

Besides the loan, what are the other costs of owning a car?

Your monthly loan payment is just one piece of the puzzle. The total cost of car ownership also includes:

Car Insurance: This is mandatory and can be a significant monthly expense, especially for younger drivers or more expensive cars.

Fuel: Use the car’s MPG (miles per gallon) rating to estimate your weekly or monthly fuel costs.

Maintenance & Repairs: Budget for routine maintenance like oil changes, tire rotations, and brakes. A good rule of thumb is to set aside

$50 - $100per month for future repairs.Registration & Fees: You will have annual costs for vehicle registration and state inspections.

What is GAP Insurance and do I need it?

GAP (Guaranteed Asset Protection) insurance is an optional product that covers the “gap” between what your car is worth and what you still owe on your loan if your car is totaled or stolen. If you make a small down payment (less than 20%) or take out a long-term loan (60+ months), you may be “upside down” for the first few years. In this case, GAP insurance is a wise investment to protect you from a major financial loss.

Take the Next Step

Now that you’ve estimated your car payment, see how it fits into your overall budget with our Debt-to-Income Ratio Calculator. You can also explore different loan scenarios with our Loan Amortization Calculator to see a full payment-by-payment breakdown.

Creator