APR Calculator: Find the True Cost of Your Loan

Comparing loan offers can be confusing when you see different interest rates and fees. Our APR Calculator helps you look past the advertised interest rate to find the Annual Percentage Rate (APR), giving you a more accurate measure of the true cost of borrowing. Use this tool to confidently compare offers and choose the loan that’s right for you.

Real APR

0.000%

Loan Details

How to Use Our APR Calculator

To find the APR, you’ll need the basic loan details and any associated fees. This information is typically found on the Loan Estimate document provided by a lender.

Loan Amount: Enter the total amount of money you plan to borrow.

Interest Rate (%): Enter the “headline” or nominal interest rate offered by the lender. This is the rate before any fees are considered.

Loan Term (Years): Input the total time you have to repay the loan, such as 30 years for a mortgage or 5 years for an auto loan.

Loan Fees: This is the most important input for calculating APR. Add up all the lender fees required to get the loan. This can include origination fees, underwriting fees, broker fees, and closing costs.

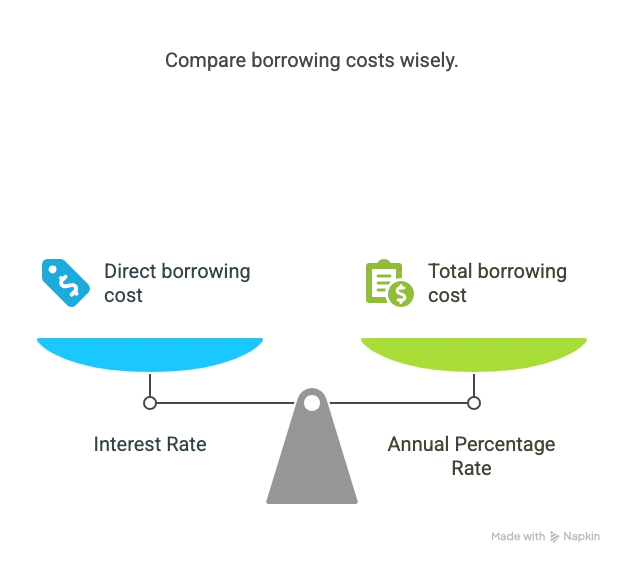

Understanding Your Results: APR vs. Interest Rate

Your result is the Annual Percentage Rate (APR). In almost every case, you will notice that the APR is higher than the interest rate you entered. This is by design and reveals the true cost of the loan.

Think of it this way:

The Interest Rate is like the sticker price of a car.

The APR is the final, “out-the-door” price after including mandatory fees and taxes.

The APR is a more powerful comparison tool because it standardizes the cost of borrowing. It represents the annual cost of the loan, including fees, expressed as a single percentage. When you compare the APR of two different loan offers, you are making a more accurate, apples-to-apples comparison of which loan will actually cost you less.

Consider this example of two $20,000 personal loan offers over 5 years:

| Metric | Loan Offer A | Loan Offer B |

| Loan Amount | $20,000 | $20,000 |

| Interest Rate | 7.0% | 7.2% |

| Lender Fees | $900 | $100 |

| Calculated APR | 8.71% | 7.62% |

Even though Loan Offer A has a lower interest rate, it is actually the more expensive loan once the high fees are factored in. The APR reveals that Loan Offer B is the better deal.

(A bar chart comparing the Interest Rate and APR for Loan A and Loan B would be placed here, visually showing the gap created by fees.)

Frequently Asked Questions

What is the real difference between APR and interest rate?

The interest rate is simply the cost of borrowing the principal loan amount. The Annual Percentage Rate (APR) is a broader measure that includes the interest rate plus all the mandatory fees associated with the loan (like origination fees or closing costs). Because it includes these extra costs, the APR gives you a more complete picture of what you’ll pay annually. A loan with a low advertised interest rate but high fees could have a higher APR than a loan with a slightly higher interest rate but no fees.

What kinds of fees are typically included in APR?

The fees included in an APR calculation are any charges that are required by the lender to get the loan. Common examples include:

Origination or underwriting fees

Loan processing fees

Broker fees

Discount points (fees paid upfront to lower your interest rate)

Mortgage insurance premiums

Closing costs

Application fees or third-party costs like appraisals and credit reports are not always included, so it’s important to review your Loan Estimate carefully.

Is a lower APR always the better choice?

Generally, yes. When comparing two loans of the same type (e.g., two 30-year fixed mortgages), the one with the lower APR will cost you less over the life of the loan. However, there are exceptions. You should also consider:

Fixed vs. Variable Rates: A variable-rate loan might have a very low introductory APR, but that rate can increase significantly later. A fixed-rate loan may have a slightly higher starting APR but offers stability and predictability.

Loan Term: A 15-year mortgage will have a higher monthly payment but a lower APR and less total interest paid than a 30-year mortgage.

How does my credit score affect my APR?

Your credit score is one of the most significant factors determining your APR. Lenders use your credit score to assess your risk as a borrower. A higher credit score demonstrates a history of responsible borrowing, making you a lower risk. Lenders reward this with better terms, including a lower APR. Conversely, a lower credit score signifies higher risk, leading lenders to charge a higher APR to compensate.

What is a “good” APR?

A “good” APR is a moving target that depends heavily on the type of loan, the current market environment (as influenced by Federal Reserve rates), and your personal creditworthiness. As of mid-2025, here are some general benchmarks:

Mortgage: A good APR for a 30-year fixed mortgage for someone with excellent credit might be in the 6.0% – 7.5% range.

Auto Loan (New): Borrowers with top-tier credit could see APRs between 5.5% and 7.5%.

Personal Loan: These are unsecured, so rates are higher. A good APR could range from 8% to 15% for strong credit applicants.

Credit Card: Credit card APRs are much higher, often ranging from 19% to 29% or more.

Why are there two APRs listed on my mortgage Loan Estimate?

The official mortgage Loan Estimate form includes a “Comparisons” section that often shows two APR calculations. The standard APR is what this calculator finds. The second figure, “In 5 Years,” calculates the total amount you will have paid in principal, interest, mortgage insurance, and loan costs over the first five years, represented as a percentage of your loan amount. This figure is designed to help you compare loans more effectively, especially if one loan has higher upfront costs than another.

Take the Next Step in Your Financial Planning

Now that you can compare the true cost of loans, put that knowledge to use.

Calculate your potential monthly bill for any loan offer with our simple Loan Payment Calculator.

Before you commit, see how a new loan might impact your overall budget with our Debt-to-Income (DTI) Ratio Calculator.

If you’re focused on a home loan, get a complete picture of your monthly housing costs with our all-in-one Mortgage Calculator with PITI & PMI.

Creator