Annuity Payout Calculator: See Your Guaranteed Monthly Income

Turning your annuity balance into a predictable income stream is the final and most important step in the annuity process. This calculator helps you determine your estimated monthly or annual payments based on your account value and the specific payout structure you choose.

Your Annuity Payout

$0

Total Payments: $0 | Total Interest: $0

Annuity Balance Over Time

How to Use Our Annuity Payout Calculator

Provide the details of your annuity contract to see a clear estimate of the income you will receive. This process is often called “annuitization.”

Annuity Account Balance ($): Enter the total value of your annuity at the time you plan to start taking payments. This is the principal amount that will be converted into an income stream.

Payout Period (Years): Specify how long you want to receive payments. For a guaranteed lifetime income, you can select “For Life.” Otherwise, enter a fixed number of years (e.g., 20).

Annual Interest Rate (%): This is the “annuitization rate” that the insurance company uses to calculate your payments. It is an interest rate that reflects current market conditions and is a critical part of your annuity contract. It is not the same as the growth rate during the accumulation phase.

Payout Frequency: Choose whether you want to calculate your payments on a Monthly or Annual basis.

Understanding Your Results

The calculator’s primary result is your Estimated Periodic Payout. This is the consistent, regular payment you will receive from the insurance company. Each payment you receive is composed of two parts:

A Return of Your Principal: A portion of the original amount you invested.

Interest Earned: A portion of the earnings calculated using the annuitization rate.

This is similar to a reverse mortgage payment—the insurance company is systematically paying your balance back to you, plus interest.

How Your Payout is Calculated

The stream of payments is designed to exhaust your principal and all its future interest earnings over the precise period you select.

Here is a simplified look at how an annuity balance amortizes over the first few months of a payout:

| Month | Starting Balance | Payment Received | Interest Portion | Principal Portion | Ending Balance |

| 1 | $200,000.00 | $1,192.35 | $666.67 | $525.68 | $199,474.32 |

| 2 | $199,474.32 | $1,192.35 | $664.91 | $527.44 | $198,946.88 |

| 3 | $198,946.88 | $1,192.35 | $663.16 | $529.19 | $198,417.69 |

(Example assumes a $200k balance, 20-year term, and 4% interest rate.)

As you can see, each payment you receive reduces your principal balance until it reaches zero at the end of the payout period.

Frequently Asked Questions

What is the difference between the ‘accumulation’ and ‘payout’ phases?

Annuities have two distinct stages:

Accumulation Phase: This is the growth period. You fund the annuity with a lump sum or series of payments, and the money grows on a tax-deferred basis. You are not receiving any income from the annuity.

Payout (Annuitization) Phase: This is the income period. You trigger the annuitization process, and the insurance company converts your account balance into a stream of guaranteed payments. This calculator deals exclusively with the payout phase.

What are my payout options and how do they change my payment amount?

The payout option you select is a permanent decision that directly impacts your monthly income. A higher degree of certainty or guarantees for beneficiaries results in a lower monthly payment for you.

Life Only (Single Life): Provides the highest possible monthly payment. Payments continue for your entire life and stop immediately upon your death. Nothing is left for heirs.

Period Certain: Guarantees payments for a minimum number of years (e.g., 10 or 20). If you die within that period, your beneficiary receives the remaining payments. This results in a slightly lower payment than Life Only.

Joint and Survivor: Provides payments for as long as either you or your designated beneficiary (usually a spouse) is alive. It offers the most security for a couple but provides the lowest initial monthly payment.

Lump Sum: Instead of annuitizing, you can choose to withdraw the entire account balance at once. This provides maximum flexibility but forfeits the guarantee of lifetime income and can have significant tax consequences.

What is an ‘annuitization rate’ and how is it determined?

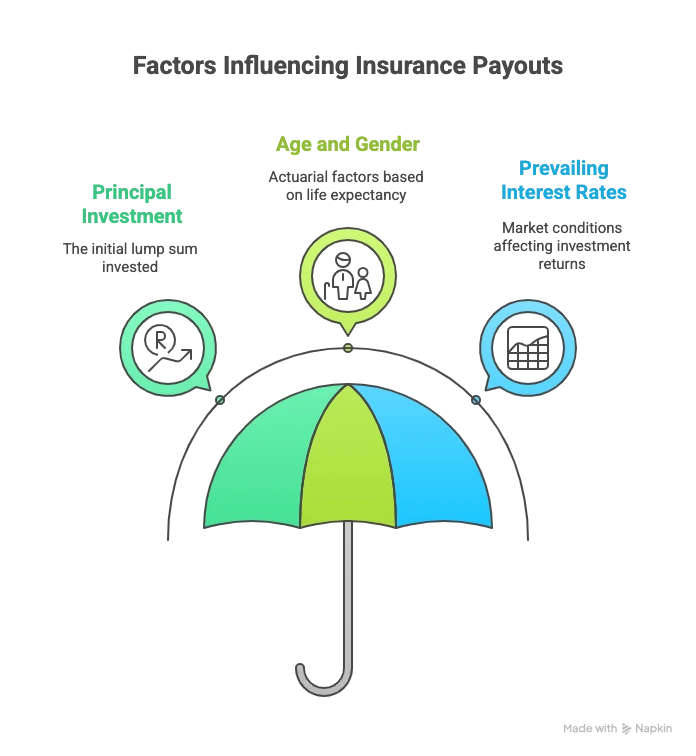

The annuitization rate is the interest rate the insurance company uses in its formula to calculate the size of your regular payments. This rate is locked in when you begin the payout phase. It is primarily determined by:

Current Interest Rates: The prevailing interest rates in the market when you annuitize. A higher interest rate environment generally leads to higher annuity payments.

Your Life Expectancy: For lifetime payout options, actuaries use your age and gender to estimate how long you will live.

This rate is a crucial part of your annuity contract and should be clearly stated by your insurance provider.

Are the annuity payments I receive taxable?

Yes, a portion of the payments you receive is typically taxable. The exact tax treatment depends on whether the annuity is “Qualified” or “Non-Qualified.”

Qualified Annuity (funded with pre-tax money like a 401k): 100% of every payment you receive is taxed as ordinary income.

Non-Qualified Annuity (funded with after-tax money): Each payment is considered partially a tax-free return of your principal and partially taxable earnings. The insurance company calculates an “exclusion ratio” to determine what percentage of each payment is taxable.

Can I change or stop my annuity payments once they start?

Generally, no. The decision to annuitize is irrevocable. Once you convert your lump sum into a stream of payments, you cannot change the payment amount, the frequency, or the payout option you selected. You give up control and liquidity of your principal in exchange for the security of a guaranteed income stream. This is a critical trade-off to understand before beginning the payout phase.

How can I protect my annuity payments from inflation?

A fixed annuity payment will lose purchasing power over time due to inflation. To combat this, you can purchase an annuity with a Cost-of-Living Adjustment (COLA) rider. This rider will increase your annual payments by a fixed percentage (e.g., 3%) or by the rate of inflation each year. However, selecting a COLA rider will significantly reduce your initial starting payment amount compared to a level-payment annuity.

Now that you’ve estimated your annuity income, the next step is to see how it fits into your monthly spending plan. Use our Budget Calculator to manage your cash flow in retirement. To see how this guaranteed income stream fits with your other assets like Social Security and investments, input the result into our comprehensive Retirement Calculator.

Creator