Annuity Calculator: Estimate Your Guaranteed Income Payout

Understanding how a lump-sum investment can translate into a predictable stream of retirement income is a key financial planning question. This annuity calculator helps you estimate your potential monthly or annual payouts based on the type of annuity, your investment amount, and your time horizon.

Future Value of Annuity

$0

Starting Principal

$0

Total Additions

$0

Total Interest Earned

$0

Annuity Growth Over Time

How to Use Our Annuity Calculator

To estimate your potential income, provide the following details. The results will help you compare different scenarios for your retirement.

-

Total Investment: Enter the lump-sum amount you plan to use to purchase the annuity. This is the principal that will generate your future income payments.

-

Annuity Type:

-

Immediate: Choose this if you want payments to begin right away (typically within one year).

-

Deferred: Choose this if you want to let your investment grow for a period of time before starting payments in the future.

-

-

Your Age Now: Enter your current age.

-

Payout Start Age: For a deferred annuity, this is the age you want payments to begin. For an immediate annuity, this will be your current age.

-

Annual Growth Rate (%): (For Deferred Annuities Only) Enter the estimated average annual return you expect your investment to earn during the “accumulation” phase, before payments begin.

-

Payout Period (Years): How long do you want to receive payments? You can enter a specific number of years (e.g., 20) or select “For Life” for a lifetime income stream.

-

Payout Interest Rate (%): This is the interest rate the insurance company uses to calculate your periodic payments during the payout phase. This is also known as the “annuitization rate.”

Understanding Your Results

The main result of the calculator is your Estimated Periodic Payout. This is the amount of income you can expect to receive on a regular basis (e.g., monthly) from your annuity. This number is determined by your initial investment, the growth during any deferral period, and the length of time over which the insurance company agrees to pay you.

Annuities: More Than Just a Number

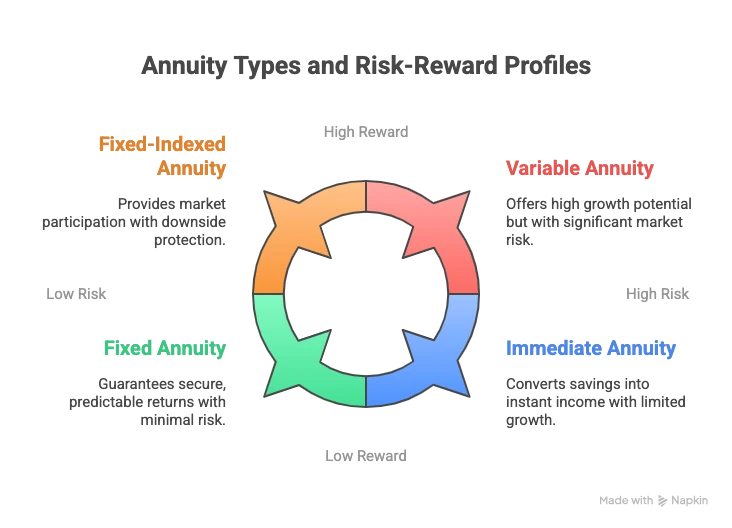

The calculator provides an estimate, but the type of annuity you choose has a massive impact on your real-world outcome. Insurance companies offer several kinds, each with different risk and growth potential.

| Annuity Type | How It Works | Best For… | Key Risk |

| Fixed Annuity | The insurance company guarantees a fixed interest rate for a set period. Your payout is predictable and stable. | Conservative investors who prioritize safety and predictable income over high growth. | Inflation Risk: Your fixed payments may not keep up with the rising cost of living over time. |

| Variable Annuity | You invest your principal in sub-accounts similar to mutual funds (stocks, bonds). Your payout depends on market performance. | Investors with a higher risk tolerance seeking greater growth potential to combat inflation. | Market Risk: Your principal and income can decrease if your investments perform poorly. |

| Fixed-Indexed Annuity | Offers a guaranteed minimum return (like a fixed annuity) but also offers growth potential tied to a market index (like the S&P 500), usually with a cap on gains. | Moderate investors who want a balance of safety and growth potential, protecting them from market downturns. | Complexity & Caps: The formulas can be complex, and growth potential is limited by participation rates and caps. |

Frequently Asked Questions

What is an annuity and who is it for?

An annuity is a contract between you and an insurance company. In its simplest form, you pay the company a sum of money (a premium), and in return, they agree to pay you a stream of income for a set period or for the rest of your life. Annuities are primarily designed for retirees or those approaching retirement who want to create a guaranteed income stream and reduce the risk of outliving their savings. They are a tool for income, not for high-growth investment.

How are annuities taxed?

Taxation depends on how you funded the annuity.

-

Qualified Annuity: Funded with pre-tax money, like rolling over a 401(k) or Traditional IRA. Every dollar you withdraw (both principal and earnings) is taxed as ordinary income.

-

Non-Qualified Annuity: Funded with after-tax money. You have already paid taxes on your principal contributions. Therefore, only the earnings portion of your withdrawals are taxed as ordinary income. The portion of each payment that is a return of your principal is tax-free.

What are the fees associated with annuities?

Annuities, particularly variable and indexed types, are known for their fees, which can reduce your overall return. Common fees include:

-

Mortality and Expense (M&E) Charges: A fee for the insurance component (like the death benefit).

-

Administrative Fees: Flat fees for record-keeping.

-

Fund Management Fees: Fees for the underlying investment sub-accounts in a variable annuity.

-

Rider Fees: Extra charges for optional benefits like a guaranteed income rider.

-

Surrender Charges: A significant penalty (often 7% or more) if you withdraw more than a specified amount before a certain period (the surrender period) has passed, typically 5-10 years.

What are annuity ‘riders’ and are they worth it?

A rider is an optional add-on to an annuity contract that provides extra benefits or guarantees, for an additional annual fee. Common riders include:

-

Guaranteed Lifetime Withdrawal Benefit (GLWB): Allows you to withdraw a certain percentage of your investment each year for life, even if your account value drops to zero.

-

Cost-of-Living Adjustment (COLA): Increases your annual payout to help keep pace with inflation.

-

Guaranteed Minimum Death Benefit: Ensures your beneficiaries will receive at least the amount you invested, regardless of market performance.

Whether a rider is “worth it” depends on your personal need for the guarantee versus the cost of the fee, which can range from 0.5% to 1.5% or more per year.

What happens to my annuity when I die?

This is one of the most critical questions to ask and depends entirely on the payout option you choose.

-

Life Only: This option provides the highest monthly payout, but all payments stop the moment you die. No money passes to your heirs.

-

Period Certain: This option guarantees payments for a specific period (e.g., 10 or 20 years). If you die before the period ends, your beneficiary will continue to receive payments until the end of the specified term. This results in a lower monthly payment than “Life Only.”

-

Joint and Survivor: This option provides payments for as long as either you or your spouse (or other joint annuitant) is alive. This provides the most security for a couple but results in the lowest initial monthly payment.

-

Cash Refund: If you die before receiving payments equal to your initial investment, your beneficiary receives the remaining balance as a lump sum.

Concrete Example (Period Certain): You choose a “Life with 15-Year Period Certain” annuity.

-

Scenario 1: You live for 25 years. You receive payments for all 25 years.

-

Scenario 2: You die after 8 years. Your beneficiary will receive payments for the remaining 7 years of the “period certain.”

Annuity income is just one part of a retirement strategy. To see how these potential payouts fit with your other assets like Social Security and savings, use our comprehensive Retirement Calculator. If you are comparing an annuity to other forms of guaranteed income, our Pension Calculator can provide a useful reference point.

Creator