Social Security Calculator: Estimate Your Monthly Benefit

Estimating your future Social Security income is a cornerstone of a solid retirement plan. This calculator provides a simplified estimate of your monthly retirement benefits at different claiming ages, helping you understand how your decisions can impact your financial security.

Optimal Age to Claim Benefits

--

Total Lifetime Benefit: $0

Claim at 62

$0/mo

Full Retirement

$0/mo

Claim at 70

$0/mo

Cumulative Benefits Over Time

How to Use Our Social Security Calculator

This tool provides a quick estimate to help with your financial planning. For an exact figure based on your complete earnings history, you will need to create an account at the official Social Security Administration (SSA) website.

Date of Birth: Enter your date of birth (month, day, year). This is the most critical factor, as it determines your Full Retirement Age (FRA).

Highest Annual Income ($): Enter your single highest year of earnings. The official SSA calculation uses your top 35 years of indexed earnings, which is complex. Using your highest income provides a useful, simplified estimate for planning purposes, as it’s a strong indicator of your average lifetime earnings.

Understanding Your Results

The calculator shows your Estimated Monthly Benefit at three key claiming milestones. The results demonstrate the significant financial trade-off between claiming your benefits early versus waiting.

Your Benefit by Claiming Age

The age you start receiving benefits permanently affects the amount you receive each month.

| Claiming Age | Benefit Amount | Description |

| Early (Age 62) | Reduced Benefit: You receive the smallest monthly check, but for the longest period of time. | Your benefit is permanently reduced by up to 30% compared to waiting until your Full Retirement Age. |

| Full Retirement Age (FRA) | 100% of Your Benefit: You receive the full monthly benefit you have earned. | Your FRA is between 66 and 67, depending on the year you were born (see FAQ below). |

| Delayed (Age 70) | Maximum Benefit: You receive the largest possible monthly check. | Your benefit permanently increases by about 8% for each year you wait past your FRA, up to age 70. This can result in a benefit that is 24% or more higher than your FRA amount. |

Social Security Benefit Comparison

See how your claiming age affects your monthly benefit.

Your Full Retirement Age (FRA) is:

Frequently Asked Questions

What exactly is my ‘Full Retirement Age’ (FRA)?

Full Retirement Age is the age at which you are entitled to receive 100% of your earned Social Security benefits. The FRA is gradually increasing based on your birth year. It is not a single age for everyone.

-

For those born 1943-1954: FRA is 66.

-

For those born 1955-1959: FRA increases by 2 months each year (e.g., 66 and 2 months for 1955, 66 and 4 months for 1956, etc.).

-

For those born in 1960 or later: FRA is 67.

As of July 2025, anyone turning 65 was born in 1960, meaning their Full Retirement Age is 67.

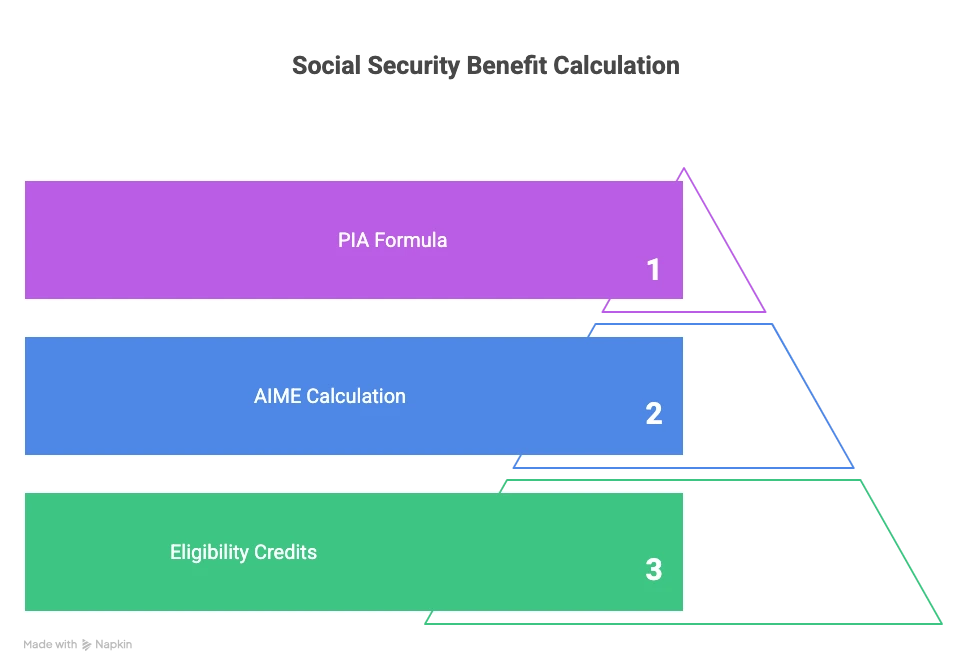

How are my Social Security benefits actually calculated?

The Social Security Administration (SSA) uses a complex formula based on your lifetime earnings. Here’s a simplified overview:

-

Index Your Earnings: The SSA takes your earnings for each year you worked and adjusts them for inflation to bring them to current-day values.

-

Find the Average: They identify your 35 highest-earning years and calculate the monthly average, known as your “Average Indexed Monthly Earnings” (AIME). If you have fewer than 35 years of earnings, zeros are averaged in for the missing years.

-

Apply the Formula: A progressive formula is applied to your AIME to determine your “Primary Insurance Amount” (PIA), which is your benefit at Full Retirement Age. The formula uses “bend points” to give lower-income earners a higher percentage of their pre-retirement income back than higher-income earners.

How does working affect my benefits if I claim early?

If you claim benefits before your Full Retirement Age and continue to work, your benefits may be temporarily reduced if your earnings exceed the annual limit. This is called the Retirement Earnings Test.

For 2025, the earnings limit is projected to be around $23,280. For every $2 you earn above this limit, the SSA will withhold $1 in benefits. In the year you reach FRA, a higher limit applies (projected around $61,680), and the withholding is $1 for every $3 earned. Once you reach your Full Retirement Age, the earnings test disappears, and you can earn any amount of money without your benefits being reduced. The withheld benefits are not permanently lost; your monthly benefit will be recalculated at your FRA to give you credit for those withheld months.

Can I receive benefits based on my spouse’s record?

Yes. This is a valuable provision known as spousal benefits. You may be entitled to a benefit equal to 50% of your spouse’s full retirement benefit, provided you are at least at your own Full Retirement Age when you claim it.

-

The Rule: You are eligible for the higher of two amounts: your own earned benefit or the spousal benefit. The SSA will not pay you both.

-

Example: Your own full benefit is $1,200/month. Your spouse’s full benefit is $3,000/month. The spousal benefit you’re entitled to is 50% of your spouse’s, or $1,500/month. Since $1,500 is higher than your own $1,200, you would receive the $1,500 spousal benefit.

-

Important Note: Claiming a spousal benefit before your own FRA will permanently reduce the amount you receive. Your spouse must have already filed for their own benefits for you to claim a spousal benefit.

Survivor benefits for widows and widowers are different and can be up to 100% of the deceased spouse’s benefit.

Are my Social Security benefits taxable?

They can be. Whether your benefits are taxed depends on your “combined income,” which is your Adjusted Gross Income (AGI) + non-taxable interest + half of your Social Security benefits.

-

Individual Filers: If your combined income is between $25,000 and $34,000, up to 50% of your benefits may be taxable. If it’s over $34,000, up to 85% may be taxable.

-

Joint Filers: If your combined income is between $32,000 and $44,000, up to 50% of your benefits may be taxable. If it’s over $44,000, up to 85% may be taxable.

These income thresholds are not indexed for inflation, so more retirees find a portion of their benefits are taxable each year.

After estimating your Social Security, the next step is to see how this income fits into your complete retirement plan. Use our all-in-one Retirement Calculator to factor in your savings and other income sources. If you also have a company pension, our Pension Calculator can help you estimate that piece of the puzzle.

Creator