Pension Calculator: Estimate Your Monthly Retirement Income

Estimating your future pension income is a vital step in mapping out a secure retirement. This calculator helps you project your potential monthly payments or lump-sum payout based on your unique service history and your plan’s specific formula.

Select a scenario to analyze

Adjust the numbers on the left to see your results.

Comparison Chart

How to Use Our Pension Calculator

To project your pension benefits, you will need some information from your plan administrator or benefits summary. Here is a guide to the inputs required.

Current Age: Enter your age as of today. This helps establish your timeline to retirement.

Planned Retirement Age: The age at which you intend to stop working and begin receiving pension benefits.

Final Average Salary ($): This is a critical component of the pension formula. It’s typically the average of your salary over the final 3-5 years of your employment. Check your plan documents for the specific calculation.

Years of Service at Retirement: Enter the total number of years you will have worked for the company when you retire. This includes your current years of service plus the years remaining until your planned retirement age.

Pension Multiplier / Accrual Rate (%): This is a percentage set by your employer, often between 1% and 2.5%. It’s the rate at which you earn your benefit each year. You can find this rate in your Summary Plan Description (SPD).

Lump Sum Discount Rate (%): If you are considering a lump-sum payout, enter the discount rate your plan uses to calculate it. This rate, often tied to corporate bond yields, is used to determine the present-day value of your future monthly payments. A higher rate results in a lower lump sum.

Understanding Your Results

The calculator provides two primary results: your Estimated Monthly Pension Payment for life and the equivalent Estimated Lump Sum Payout. Understanding the trade-offs between these two options is the most important decision you will make regarding your pension.

The Pension Formula

Your monthly pension is calculated using a straightforward formula determined by your employer:

This result represents a single-life annuity, which is a guaranteed monthly payment for the rest of your life.

Lump Sum vs. Monthly Payments: The Core Decision

Choosing between a steady stream of income and a large, one-time payment is a significant decision with long-term consequences.

| Feature | Monthly Pension Payments (Annuity) | Lump-Sum Payout |

| Primary Benefit | Income Security: Predictable, guaranteed income that you cannot outlive. It’s like a personal paycheck in retirement. | Flexibility & Control: You get all the money at once to invest, spend, or pass on to heirs as you see fit. |

| Risk | Inflation Risk: The fixed payment buys less over time as costs rise. Company Risk: Your payments depend on the long-term financial health of the pension plan. | Investment & Longevity Risk: You could run out of money if you live longer than expected or your investments perform poorly. |

| Best For | Individuals who prioritize security, want to avoid managing large sums of money, and seek a predictable income floor. | Individuals who are confident in their ability to manage investments, want to leave a larger inheritance, or need flexibility. |

| Heirs | Payments typically stop upon your death (unless you choose a survivor option, which reduces the monthly amount). | Any remaining funds can be passed directly to your beneficiaries. |

Frequently Asked Questions

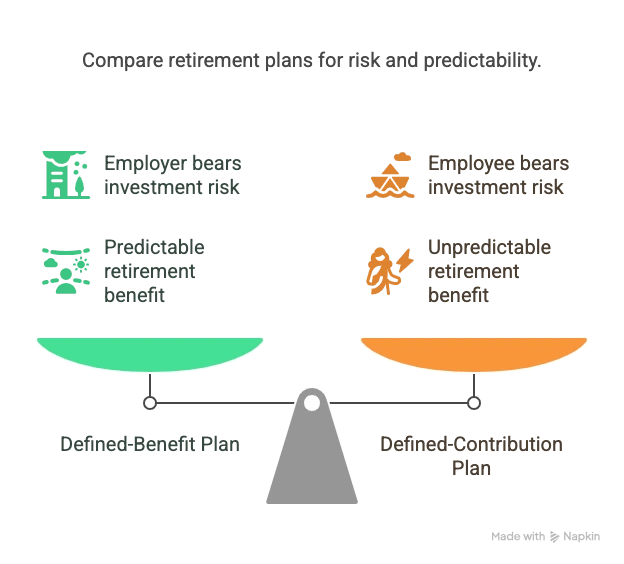

What is the difference between a pension and a 401(k)?

They represent two different retirement philosophies.

Pension (Defined Benefit Plan): Your employer funds and manages the plan, guaranteeing you a specific, predictable monthly income in retirement based on a formula. The investment risk is entirely on the employer.

401(k) (Defined Contribution Plan): You and your employer both contribute to an individual account in your name. The final amount depends on how much you save and how your investments perform. The investment risk is entirely on you.

How are ‘Years of Service’ and ‘Final Average Salary’ calculated?

These terms are defined specifically by your pension plan documents, so you must check them.

Years of Service: This is usually straightforward, but some plans may have rules about breaks in service or part-time work. It’s crucial to confirm how your employer calculates your total credited service.

Final Average Salary (FAS): This is not just your last year’s salary. Most plans average your earnings over a specific period, such as the highest-earning 60 consecutive months (5 years) or the final 36 months (3 years) of employment. Using an incorrect FAS is one of the most common errors when estimating a pension.

What are my pension survivor options?

When you retire, you don’t just choose a pension; you choose a payment schedule. A single-life annuity provides the highest monthly payment but stops when you die. A joint-and-survivor annuity provides income for both you and your spouse.

Concrete Example: Let’s say your full, single-life pension benefit is $2,000/month.

50% Joint-and-Survivor: You might receive a reduced payment of $1,800/month. When you pass away, your surviving spouse would then receive 50% of that, or $900/month, for the rest of their life.

100% Joint-and-Survivor: You might receive a further reduced payment of $1,650/month. However, when you pass away, your surviving spouse would continue to receive the same $1,650/month for life.

Choosing a survivor option permanently reduces your monthly payment but provides a crucial safety net for your spouse.

Is my pension protected if my company goes bankrupt?

For most private-sector pension plans, yes. They are protected by a federal agency called the Pension Benefit Guaranty Corporation (PBGC). If your company fails and the pension plan is underfunded, the PBGC will take over the plan and pay retiree benefits up to a certain legal limit. For 2025, the maximum guaranteed benefit for a 65-year-old in a single-life annuity is $6,750 per month ($81,000 per year). While this protects most peoples’ benefits, very high earners may not receive their full promised pension amount.

How is my pension income taxed?

Pension income is taxed as ordinary income at the federal and (most) state levels. It’s treated just like the wages you earned while working. If you take a lump-sum payout and roll it over directly into a traditional IRA, you will not pay taxes at that time. Taxes will be due on the withdrawals you make from that IRA in retirement. If you take the lump sum as cash directly, it will be considered a massive taxable event in that year.

After estimating your pension, it’s important to see how it fits with your other assets. Use our comprehensive Retirement Calculator to combine your pension, Social Security, and other savings into one complete picture. If you also have a defined contribution plan, our 401(k) Calculator can help you project its future value.

Creator