401k Calculator: Project Your Retirement Savings Growth

Understanding how your 401k can grow is the key to effective retirement planning. This calculator helps you visualize your potential 401k balance at retirement by projecting the growth of your contributions, your employer’s match, and your investment returns.

Estimated 401(k) Balance at Retirement

$0

Your Total Contributions

$0

Total Employer Match

$0

Total Investment Growth

$0

Projected Growth Over Time

Retirement Distributions

Estimated monthly payout from retirement until your life expectancy.

Estimated Monthly Payout

$0

How to Use Our 401k Calculator

Enter a few key details about your savings plan to see a detailed projection. Here’s what each field means.

Current Balance: Enter the total amount of money you currently have in your 401k account.

Current Age: Your age today. This determines how many years your investments have to grow.

Retirement Age: The age you plan to retire. Most people aim for an age between 60 and 67.

Your Monthly Contribution ($): The dollar amount you personally contribute from your paycheck to your 401(k) each month.

Employer Match (%): The percentage of your contribution that your employer matches. For example, if your employer matches 50%, they contribute $0.50 for every $1 you contribute.

Employer Match Limit (%): The maximum percentage of your salary your employer will match. For example, a common match is “50% of contributions up to 6% of your salary.” In this case, you would enter 6%.

Annual Salary ($): Enter your total gross annual salary. This is needed to accurately calculate the employer match based on the limit.

Annual Rate of Return (%): Your estimated average annual return on your 401k investments. A long-term historical average for a diversified stock portfolio is often between 7% and 9%, but you can adjust this based on how your funds are invested.

Understanding Your Results

The final number you see is your Estimated 401k Balance at Retirement. This isn’t just a simple sum of your savings; it’s a powerful projection showing what your money can become. The real value is in seeing where that final number comes from.

The Three Engines of Your 401k Growth

Your final balance is built from three distinct sources. For many people, their own contributions make up less than half of their final nest egg.

| Component | Description | Why It’s Important |

| Your Contributions | This is the total amount of money you personally save from your own paychecks over your career. | This is the foundation of your savings. The more you contribute, especially early on, the more fuel you give the other two engines. |

| Employer Match | This is the total amount of free money your employer contributes to your account as a benefit. | This is an immediate, guaranteed return on your investment. Failing to get the full match is like turning down a pay raise. |

| Total Investment Growth | This is the money your money earns over time through compounding. It’s the earnings on your contributions and your employer’s contributions. | Over decades, this is often the most powerful component and can account for the majority of your final balance. |

Imagine your 401k growth as a snowball rolling downhill. Your contributions are the core of the snowball, the employer match makes it instantly bigger, and the investment growth is the new snow it picks up as it rolls, accelerating its size over time.

Retirement Savings Breakdown

See where your retirement money comes from.

Total Nest Egg

$0

Your Contributions

$0

Employer Match

$0

Investment Growth

$0

Frequently Asked Questions

How much should I contribute to my 401k?

The simple answer is as much as you can comfortably afford, but here’s a practical hierarchy:

-

Contribute enough to get the full employer match. This is non-negotiable. If your employer matches up to 6% of your salary, you should contribute at least 6%. Anything less is leaving free money on the table.

-

Aim for a total of 15% of your pre-tax income. This 15% target (including the employer match) is a widely recommended benchmark to ensure you’re on track for a comfortable retirement.

-

Work towards maxing out your 401(k). If you can afford it, contributing the annual maximum set by the IRS ($23,000 in 2024, with an additional $7,500 catch-up for those 50 and over) is the fastest way to build your nest egg.

What is ‘vesting’ and why does it matter?

Vesting determines when you have full ownership of the money your employer has contributed to your 401(k). Your own contributions are always 100% yours. However, the employer match funds often come with a vesting schedule.

-

Cliff Vesting: You become 100% vested after a specific period, like 3 years. If you leave your job before that, you may forfeit all employer-matched funds.

-

Graded Vesting: You gain ownership in increments. For example, you might be 20% vested after one year, 40% after two, and so on, until you are 100% vested.

Understanding your company’s vesting schedule is critical if you plan on changing jobs.

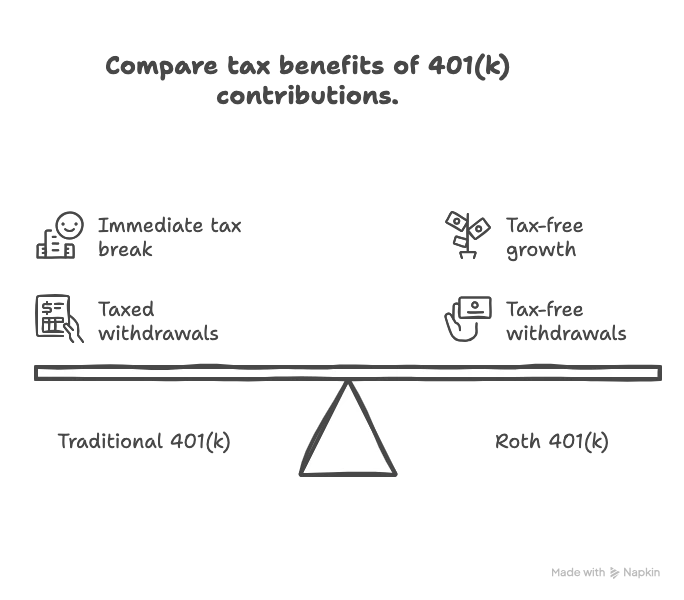

Should I contribute to a Traditional or Roth 401k?

Many companies now offer both options. The choice depends on when you want to pay taxes.

-

Traditional 401(k): You contribute pre-tax dollars. This lowers your taxable income today, giving you an immediate tax break. You pay income tax on all withdrawals in retirement.

-

Roth 401(k): You contribute after-tax dollars. There’s no tax break today, but all your qualified withdrawals in retirement (both contributions and earnings) are 100% tax-free.

Concrete Example: Assume you contribute $5,000 and are in a 22% tax bracket now and expect to be in the same bracket in retirement.

-

Traditional: You save

$5,000 x 22% = $1,100on taxes today. If that $5,000 grows to $50,000 by retirement, your withdrawal will be taxed. At a 22% rate, you’d owe$11,000in taxes. -

Roth: You get no tax break today. If that $5,000 grows to $50,000, you can withdraw the entire amount in retirement with $0 owed in taxes.

General Rule: If you expect to be in a higher tax bracket in retirement, the Roth 401(k) is often better. If you expect to be in a lower tax bracket, the Traditional 401(k) may be more advantageous.

What happens to my 401k if I leave my job?

You have several options, and you should never just “cash out.”

-

Leave it in the old plan: You can usually leave the money in your former employer’s plan (if the balance is over a certain amount, typically $5,000).

-

Roll it over to your new employer’s 401(k): This consolidates your accounts into one, making them easier to manage.

-

Roll it over into an IRA (Individual Retirement Arrangement): This is often the best choice, as an IRA gives you more control and a wider range of investment options than most 401(k) plans.

-

Cash it out: This is almost always a bad idea. You will have to pay income taxes on the entire amount plus a 10% early withdrawal penalty if you are under 59.5.

What are the best investment choices inside my 401k?

Most 401(k) plans offer a limited menu of investment options, typically mutual funds. For most people, the simplest and most effective choice is a Target-Date Fund (e.g., “Target 2055 Fund”). These funds are automatically diversified across stocks and bonds and gradually become more conservative as you get closer to your retirement date. If you prefer a more hands-on approach, you can build a diversified portfolio using low-cost index funds, such as an S&P 500 index fund for stocks and a total bond market index fund for bonds.

Now that you’ve projected your 401k growth, see how it fits into your total financial picture with our comprehensive Retirement Calculator. If you’ve decided to roll over an old 401(k), our IRA Calculator can help you explore your options and project its growth.

Creator