Auto Lease Calculator with Money Factor & Residual Value

Leasing a car can offer the appeal of a new vehicle with a lower monthly payment, but understanding how that payment is calculated can be complex. Leasing uses unique terms like “money factor” and “residual value” that you don’t see with a traditional loan. Our comprehensive auto lease calculator demystifies the process, breaking down all the variables to give you an accurate estimate of your monthly payment.

Monthly Payment Breakdown

Lease vs. Buy Comparison

How to Use Our Auto Lease Calculator

A lease payment is based on many factors beyond the car’s price. Providing accurate numbers is key to getting a reliable estimate. Here’s a simple guide to each input.

MSRP: Enter the Manufacturer’s Suggested Retail Price, also known as the sticker price. You can find this on the vehicle’s window sticker.

Negotiated Price: This is the most important number you can influence. It’s the actual price you agree to pay for the car before any rebates or down payments. Always negotiate this price just as you would if you were buying.

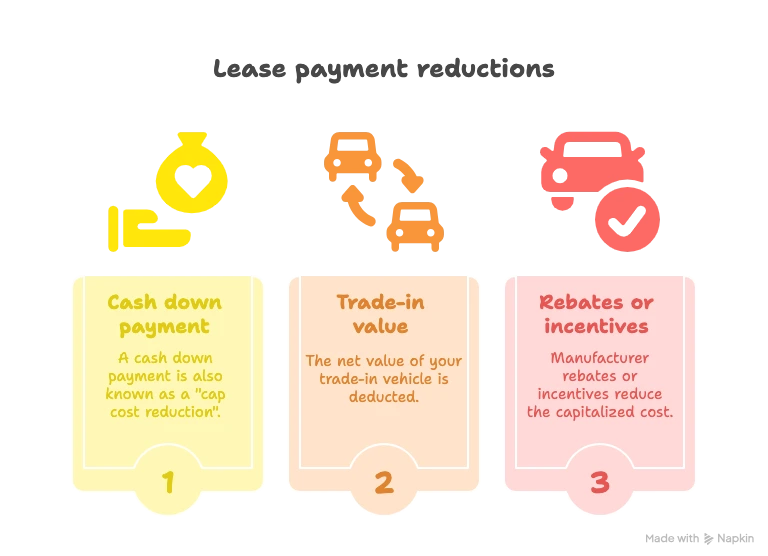

Down Payment (Capitalized Cost Reduction): This is the amount of cash you pay upfront to lower the amount you’re financing. In a lease, this is officially called a “Capitalized Cost Reduction.”

Trade-in Value & Rebates: Enter the value of your trade-in vehicle and any available manufacturer rebates or incentives. These also serve to reduce your capitalized cost.

Residual Value (%): The residual value is the car’s estimated wholesale value at the end of the lease, set by the leasing company. It is expressed as a percentage of the MSRP. A higher residual value is better for you, as it means you are financing less of the car’s depreciation.

Money Factor: This is the financing charge on a lease, similar to an interest rate on a loan. It is expressed as a small decimal (e.g., 0.00250). To convert a money factor to a more familiar APR, use this formula:

APR=Money Factor×2400So, a money factor of 0.00250 is equivalent to a

6.0%APR.Lease Term (Months): The length of your lease contract. The most common terms are 24, 36, and 39 months.

Sales Tax (%): Enter your local sales tax rate. In Texas, sales tax rules for leases are unique: tax is levied on the total purchase price of the vehicle, not the sum of the monthly payments. This is a significant cost that our calculator factors in correctly. For Houston, this rate is 8.25%.

Understanding Your Monthly Lease Payment

Your monthly lease payment is not paying off the car’s full value. Instead, you are primarily paying for the vehicle’s depreciation during the time you use it, plus finance charges. Your payment is made up of three parts:

1. The Depreciation Charge

This is the largest portion of your payment. It’s the difference between the car’s value at the start of the lease and its expected value at the end (the residual value), spread out over the lease term.

Formula:

(Net Capitalized Cost - Residual Value) / Lease TermNet Capitalized Cost is:

Negotiated Price - Down Payment - Rebates

2. The Finance Charge (or “Rent Charge”)

This is the “interest” you pay to the leasing company each month for the use of their money.

Formula:

(Net Capitalized Cost + Residual Value) * Money Factor

3. Monthly Sales Tax

This is the tax calculated on the sum of the depreciation and finance charges for that month.

Example Lease Payment Breakdown

Let’s look at a hypothetical 36-month lease on a car with a $40,000 negotiated price and a $24,000 residual value.

| Component | Calculation | Monthly Cost |

| Depreciation Charge | ($40,000 – $24,000) / 36 | $444.44 |

| Finance Charge | ($40,000 + $24,000) * 0.00250 | $160.00 |

| Base Payment | $444.44 + $160.00 | $604.44 |

| Sales Tax (8.25%) | $604.44 * 0.0825 | $49.87 |

| Total Monthly Payment | $604.44 + $49.87 | $654.31 |

Frequently Asked Questions About Car Leasing

Is it a good idea to make a large down payment on a lease?

Generally, no. It is often recommended to put as little money down as possible on a lease (a “zero down” lease). This is because if the car is stolen or totaled in an accident, your GAP insurance will cover the difference between the insurance payout and what you owe, but you will not get your down payment back. You would forfeit that thousands of dollars. It’s safer to have a slightly higher monthly payment than to risk losing a large upfront sum.

What is a good Money Factor?

A “good” money factor, like a good APR, depends on your credit score and current market rates. To determine if a money factor is competitive, convert it to an APR (Money Factor * 2400) and compare that rate to current auto loan interest rates for borrowers with a similar credit profile. As of mid-2025, a money factor of 0.00250 (6.0% APR) would be considered excellent for a prime borrower.

What happens if I drive over my mileage limit?

Every lease contract specifies an annual mileage limit (e.g., 10,000, 12,000, or 15,000 miles). If you exceed this limit by the end of the lease, you will be charged a penalty for each extra mile. This fee is typically between $0.15 and $0.30 per mile and is clearly stated in your contract. Driving 3,000 miles over your limit could easily cost you $450 - $900 at lease-end.

Leasing vs. Buying: Which is right for me?

The choice depends entirely on your financial situation and lifestyle. Neither is universally “better.”

| Aspect | Leasing | Buying |

| Monthly Payments | Typically lower. | Typically higher. |

| Upfront Costs | Often lower (first month’s payment, fees). | Often higher (large down payment needed). |

| Ownership | You never own the car. You return it. | You build equity and own it outright after the loan. |

| Customization | Not allowed. The car must be returned in original condition. | You can modify or customize it as you wish. |

| Mileage | Restricted to a set limit. | Unlimited miles. |

| Repairs | Always under warranty for the typical 3-year term. | You are responsible for all repairs after the warranty expires. |

| Best For… | People who want a new car every 2-3 years and prefer lower payments without long-term commitment. | People who drive a lot, want to keep their car for many years, and prefer to build equity. |

How can I get out of a car lease early?

Exiting a lease before the term ends can be expensive, but you have a few options:

Lease Transfer/Swap: Services like Swapalease or Leasetrader allow you to find someone to take over the remainder of your lease.

Sell the Car: You can get a payoff quote from your leasing company and sell the car to a third party or another dealership (like CarMax). If the sale price is higher than your payoff amount, you can pocket the difference.

Early Buyout: You can purchase the car yourself for the buyout price and then resell it.

Continue Your Research

If you’re still deciding on the best path forward, our Lease vs. Buy Calculator provides a detailed financial breakdown between the two options. If you’ve decided leasing isn’t for you, use our Auto Loan Calculator to estimate payments for purchasing your next vehicle.

Creator