Free Income Tax Calculator: See Your Federal, State & FICA Taxes

Estimating your total income tax liability helps you budget effectively and avoid surprises when you file your return. Use our free income tax calculator to see a detailed breakdown of your federal, state, and FICA taxes, and determine your estimated take-home pay.

Tax Breakdown by Bracket

Income Allocation

Calculation Details

How to Use Our Income Tax Calculator

To get an accurate estimate, you’ll need to provide a few key pieces of information. Here’s a simple explanation of each input field.

-

Gross Annual Income: Enter your total salary or wages for the year before any taxes or other deductions are taken out. If you’re a salaried employee, this is your yearly salary.

-

Filing Status: Select the filing status you will use on your tax return. This choice is critical as it determines your standard deduction and tax brackets.

-

Single: For unmarried individuals.

-

Married Filing Jointly: For married couples who choose to file one return together.

-

Married Filing Separately: For married couples who choose to file individual returns.

-

Head of Household: For unmarried individuals who pay more than half the costs of keeping up a home for a qualifying person.

-

-

State: Choose the state where you live and earn income. This allows the calculator to estimate your state income tax liability. Note that some states (like Texas, Florida, and Washington) have no state income tax.

-

Number of Dependents: Enter the number of qualifying children (under 17) or other dependents you claim on your tax return. This is used to calculate potential tax credits, such as the Child Tax Credit.

-

Deductions: You can lower your taxable income by taking deductions.

-

Standard Deduction: This is a fixed dollar amount that you can subtract from your income. Most taxpayers use the standard deduction because it’s simpler. Our calculator will automatically apply the correct standard deduction for your filing status.

-

Itemized Deductions: If you have significant deductible expenses (like mortgage interest, high medical bills, or large charitable donations), you can choose to itemize them instead. Select “Itemized” and enter your total estimated amount here.

-

Understanding Your Results

Your results show an estimate of your total tax burden for the year, your effective tax rate, and what you can expect to take home. Here’s a breakdown of what each number means.

| Result Component | What It Means |

| Gross Annual Income | The total income you entered at the start. |

| Federal Tax Liability | The estimated amount you owe to the U.S. federal government, calculated using the 2025 marginal tax brackets. |

| State Tax Liability | The estimated amount you owe to your state government. This will be $0 if you live in a state with no income tax. |

| FICA Taxes | This stands for Federal Insurance Contributions Act. It’s a mandatory U.S. payroll tax that funds Social Security and Medicare. It’s a separate tax from your federal income tax. |

| Total Tax Liability | The sum of your Federal, State, and FICA taxes. This is your estimated total tax burden for the year. |

| Total Take-Home Pay | Your Gross Annual Income minus your Total Tax Liability. This is the net amount you have left for living expenses, savings, and other goals. |

| Effective Tax Rate | Your Total Tax Liability divided by your Gross Annual Income. This is your actual, blended tax rate on every dollar you earned. |

A key takeaway is that your Effective Tax Rate is almost always lower than your top marginal tax bracket. This is because our progressive tax system only taxes income within each bracket at that specific rate, not your entire income.

Frequently Asked Questions

What’s the difference between a tax deduction and a tax credit?

This is one of the most important concepts in taxes. While both are good, a tax credit is much more powerful.

-

A Tax Deduction reduces your taxable income. Its value depends on your tax bracket.

-

A Tax Credit directly reduces your tax bill, dollar for dollar.

Concrete Example: Assume you are in the 22% tax bracket.

-

A $1,000 deduction reduces your taxable income by $1,000. The actual savings to you is $1,000 * 22% = $220.

-

A $1,000 tax credit reduces your final tax bill by $1,000.

As you can see, the tax credit provides a much larger financial benefit. Our calculator accounts for common credits like the Child Tax Credit.

What are tax brackets and how do they work?

The U.S. uses a progressive tax system, which means people with higher taxable incomes are subject to higher tax rates. These rates are organized into “tax brackets.” It’s a common misconception that if you fall into a higher bracket, all your income is taxed at that higher rate. This is false.

Only the portion of your income that falls within a specific bracket is taxed at that rate.

Concrete Example (using 2024 single filer rates for illustration): Let’s say a single filer has a taxable income of $50,000.

-

The first $11,600 is taxed at 10% = $1,160

-

The income from $11,601 to $47,150 ($35,550) is taxed at 12% = $4,266

-

The remaining income from $47,151 to $50,000 ($2,849) is taxed at 22% = $626.78

Total Federal Tax: $1,160 + $4,266 + $626.78 = $6,052.78. The taxpayer’s top marginal rate is 22%, but their effective tax rate is $6,052.78 / $50,000 = 12.1%.

How can I legally lower my tax bill?

While paying taxes is a civic duty, you should only pay what you legally owe. Here are three common strategies for lowering your taxable income:

-

Maximize Pre-Tax Retirement Contributions: Money you contribute to a traditional 401(k) or a traditional IRA is often deductible. This reduces your taxable income for the year while also building your retirement savings.

-

Use a Health Savings Account (HSA): If you have a high-deductible health plan, you can contribute to an HSA. Contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free—a triple tax advantage.

-

Look for Tax Credits: Don’t miss out on credits you might be eligible for, such as the Child Tax Credit, the American Opportunity Tax Credit for education expenses, or credits for energy-efficient home improvements.

Why is my actual paycheck smaller than what the calculator shows?

Our calculator estimates your income tax liability. However, your employer’s payroll department will likely withhold money for other things besides taxes. These are typically pre-tax deductions and can include:

-

Contributions to your 401(k) or other retirement plans.

-

Premiums for health, dental, and vision insurance.

-

Contributions to a Flexible Spending Account (FSA) or Health Savings Account (HSA).

-

Garnishments or other voluntary deductions.

These deductions lower your take-home pay but also often lower your taxable income, which is a benefit.

Does this calculator estimate my tax refund or how much I owe?

This calculator estimates your total tax liability for the year. It does not directly calculate your refund or final bill.

Your final refund or tax due depends on how much tax you’ve already paid throughout the year via withholdings from your paychecks (as determined by your W-4 form).

-

If Total Withholdings > Total Tax Liability, you will get a refund.

-

If Total Withholdings < Total Tax Liability, you will owe more tax.

Think of a refund not as a bonus, but as an interest-free loan you gave to the government. It’s often better to adjust your W-4 withholdings to owe a small amount or get a very small refund, keeping more of your money in each paycheck.

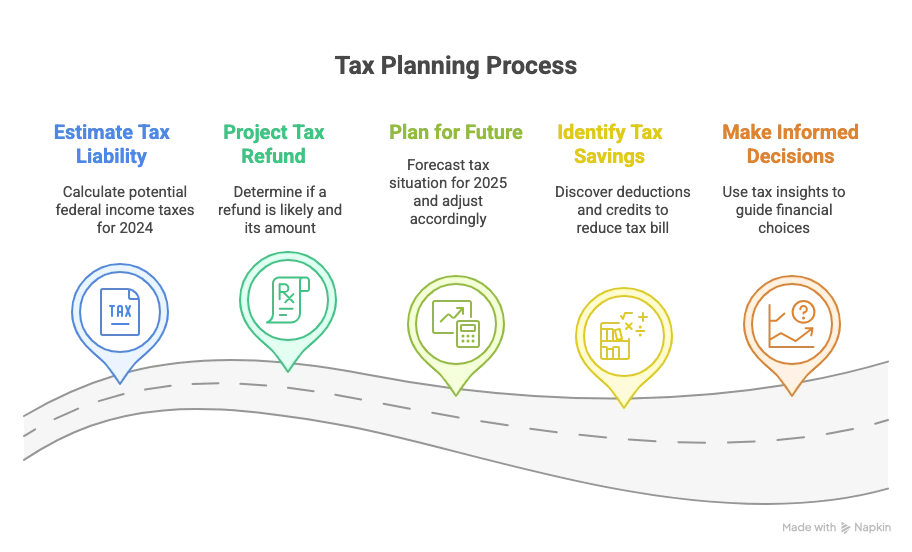

Take the Next Step in Your Financial Planning

Now that you have a clear estimate of your income and taxes, you can plan more effectively.

-

See how your income and debt levels stack up with our Debt-to-Income (DTI) Ratio Calculator.

-

Determine if your savings plan is on track for the future with our comprehensive Retirement Calculator.

Creator