VAT Calculator: Quickly Add or Remove VAT

Quickly determine the price of a product or service with or without Value Added Tax (VAT). Whether you are a business creating an invoice or a consumer checking a final price, our VAT calculator provides an instant and accurate breakdown.

Free VAT (value-added tax) calculator to find the net price, tax amount, tax rate, or gross price of a purchase.

Please provide any two values to calculate the others.

VAT Breakdown

How to Use Our VAT Calculator

Our calculator is designed for simplicity. Get the numbers you need in just a few steps:

Initial Amount: Enter the amount you are starting with. This can be the price before tax (net) or the price including tax (gross).

VAT Rate (%): Input the VAT percentage that applies. The standard rate in the UK is 20%, but rates vary by country and product type.

Choose Calculation:

Select Add VAT if your Initial Amount is the pre-tax (net) price.

Select Remove VAT (also known as a reverse VAT calculation) if your Initial Amount is the total price including tax (gross).

Understanding Your Results

The calculator will instantly provide you with three key figures: the Net Amount, the VAT Amount, and the Gross Amount. Here is what each one means and the exact formula used to calculate it.

| Term | Description | How It’s Calculated | |

| Net Amount | The price of the goods or services before any VAT is added. Also known as the base price. | When removing VAT: | Net=1+(VAT Rate/100)Gross Amount |

| VAT Amount | The total amount of tax being charged on the goods or services. | VAT Amount=Net Amount×(VAT Rate/100) | |

| Gross Amount | The final price including VAT. This is the total amount the customer pays. | When adding VAT: | Gross=Net Amount×(1+(VAT Rate/100)) |

Example Calculation:

Let’s say you have a service with a Net Amount of £100 and a standard VAT Rate of 20%.

VAT Amount:

£100 * (20 / 100) = £20Gross Amount:

£100 + £20 = £120

If you only knew the final price (£120) and wanted to find the pre-tax cost, you would perform a reverse VAT calculation.

Frequently Asked Questions

What is VAT (Value Added Tax)?

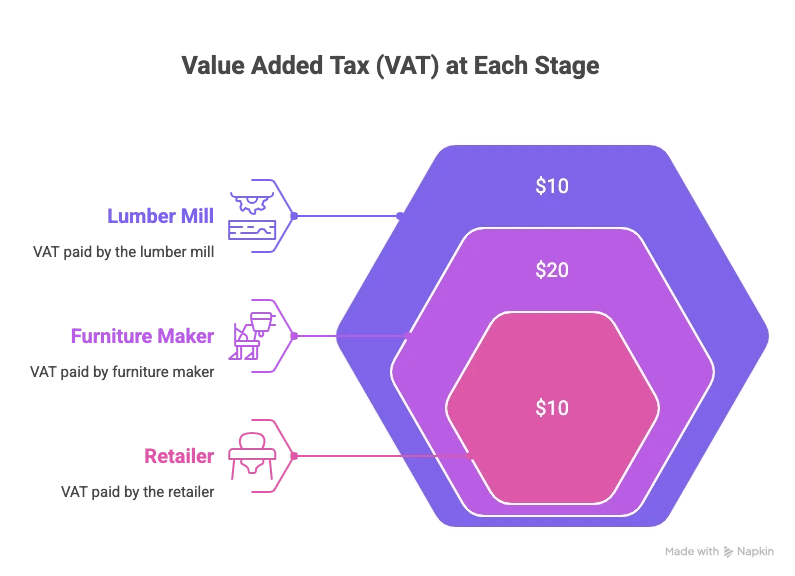

Value Added Tax (VAT) is a type of consumption tax placed on a product or service whenever value is added at each stage of the supply chain, from production to the point of sale. The end consumer ultimately pays the tax, while businesses collect it and remit it to the government. It is used in the United Kingdom and throughout the European Union, among other countries.

Who needs to charge VAT?

In most countries, businesses are only required to register for and charge VAT once their taxable turnover exceeds a certain threshold within a 12-month period. For example, as of July 2025, the VAT registration threshold in the UK is £90,000. If your business’s turnover is below this amount, you are not required to register for or charge VAT, though you can do so voluntarily.

How does a “reverse VAT” calculation work?

A reverse VAT calculation is used when you know the total (gross) price of something and need to find out how much of that price was the product’s cost and how much was the tax. This is useful for business owners who need to account for VAT from receipts that only show the total amount paid.

Concrete Example:

You paid £360 for a new office chair and the receipt only shows the total.

You know the standard VAT rate of 20% was applied.

To find the pre-tax (net) price, you use the reverse VAT formula:

Net Price = £360 / (1 + (20 / 100))Net Price = £360 / 1.20 = £300The chair cost £300 before tax, and the VAT amount was £60.

Are there different VAT rates?

Yes. While there is usually a “standard rate” (e.g., 20% in the UK), most countries also have other rates for specific goods and services to make essential items more affordable. These often include:

Reduced Rate: A lower rate applied to items like domestic fuel or energy-saving materials (e.g., 5% in the UK).

Zero Rate: A 0% rate applied to most food, books, and children’s clothing. Businesses still have to record and report these sales, but no VAT is charged to the customer.

Exempt: Some goods and services, like postage stamps or financial services, are exempt from VAT entirely.

What is the difference between VAT and Sales Tax?

While both are consumption taxes, the key difference is in how they are collected.

VAT is collected at every stage of the supply chain. A business pays VAT on its purchases (input tax) and charges VAT on its sales (output tax), then remits the difference to the government.

Sales Tax (used in the United States) is only collected at the final point of sale when the consumer buys the product. It is not collected between businesses in the supply chain.

How do I properly show VAT on an invoice?

If you are a VAT-registered business, your invoices must include specific information to be legally compliant. A full VAT invoice must show:

Your business name, address, and VAT registration number.

A unique invoice number.

The date of supply (tax point).

The customer’s name and address.

A clear description of the goods or services.

For each item, the quantity, the net price, and the VAT rate applied.

The total net amount (before VAT).

The total VAT amount.

The total gross amount (including VAT).

Take the Next Step in Your Business Finances

Now that you’ve calculated the VAT for your transaction, put that number to use.

Create a professional, compliant invoice for your customer with our free Invoice Generator.

Calculate how this transaction impacts your bottom line with our Profit Margin Calculator.

If you’re a freelancer, ensure your rates account for business costs like VAT with our Freelance & Contractor Rate Calculator.

Creator