Amortization Calculator (for Mortgage, Auto, or Personal Loans)

Understanding how your loan payments are broken down between principal and interest is key to managing your debt effectively. Our amortization calculator creates a detailed payment schedule, showing you exactly where your money goes each month and the total interest you’ll pay over the life of the loan.

Results

Monthly Payment

Amortization Schedule

| Year | Interest | Principal | Balance |

|---|

| Month | Interest | Principal | Balance |

|---|

Loan Amortization

Enter your loan details to see the full payment schedule.

How to Use Our Amortization Calculator

Provide the basic details of your loan to generate your complete payment schedule. This works for mortgages, auto loans, personal loans, and more.

Loan Amount ($): Enter the total amount of money you borrowed. For a mortgage, this is the home’s purchase price minus your down payment.

Loan Term (in years): The total length of time you have to repay the loan. Common terms are 30 or 15 years for mortgages, and 3 to 7 years for auto loans.

Annual Interest Rate (%): Enter the yearly interest rate for your loan. Be sure to use the annual rate, not a monthly one.

Understanding Your Results

The calculator generates a full amortization schedule, a table that details every single payment over the course of your loan. It gives you a complete view of how your debt is paid off over time.

Your results will include:

Monthly Payment: This is the fixed amount you will pay each month. This payment is carefully calculated to ensure your loan is paid off exactly at the end of your term.

Principal Component: The portion of your payment that directly reduces your outstanding loan balance. This amount starts small and grows larger with every payment you make.

Interest Component: The portion of your payment that goes to the lender as profit for lending you the money. The interest amount is highest at the beginning of the loan and gets smaller with every payment.

Total Interest Paid: This summary figure shows the grand total of all interest payments you’ll make over the entire loan term. This number reveals the true cost of borrowing.

Ending Balance: This column shows your remaining loan balance after each monthly payment. You can track this number as it declines all the way to

$0.

Frequently Asked Questions

Why does so much of my payment go to interest at the beginning of the loan?

This is the most common question about amortization and it comes down to how interest is calculated. Interest is calculated based on your current outstanding balance. When your loan is new, your balance is at its highest, so the amount of interest you owe is also at its highest. As you make payments and chip away at the principal, your outstanding balance shrinks. With each payment, the interest portion of your next payment gets a little smaller, and the principal portion gets a little bigger.

How do extra payments affect my amortization schedule?

Making extra payments is one of the most powerful financial moves you can make. When you pay more than your required monthly payment, that extra money is typically applied directly to the principal balance. This has a compounding effect:

It immediately reduces your loan balance.

It reduces the total amount of interest you will pay over the life of the loan, since future interest is calculated on a smaller balance.

It allows you to pay off your loan years sooner.

Concrete Example: Imagine you have a $300,000, 30-year mortgage at 7.0% interest. Your standard monthly payment is $1,996. If you pay just an extra $200 per month, you would pay off your loan 6 years and 10 months early and save over $117,000 in total interest.

What is negative amortization?

Negative amortization is a risky situation where your loan balance increases even though you are making payments. This happens when your scheduled monthly payment is less than the interest that has accrued that month. The unpaid interest is then added back to the principal balance, causing you to owe more money, not less. This can occur with certain loan types, such as some Adjustable-Rate Mortgages (ARMs) or Graduated Payment Mortgages, and should be avoided if possible.

Does amortization work the same for all types of loans?

Yes, the fundamental principle is the same for nearly all installment loans, including mortgages, auto loans, and personal loans. Any loan with a fixed interest rate and a fixed repayment term will have an amortization schedule. The primary differences you’ll see between loan types are the loan term (e.g., 30 years for a mortgage vs. 5 years for a car) and the interest rate, but the mathematical process of paying down the debt is identical.

How can I use an amortization schedule to my advantage?

An amortization schedule is more than just a table of numbers; it’s a powerful financial planning tool. You can use it to:

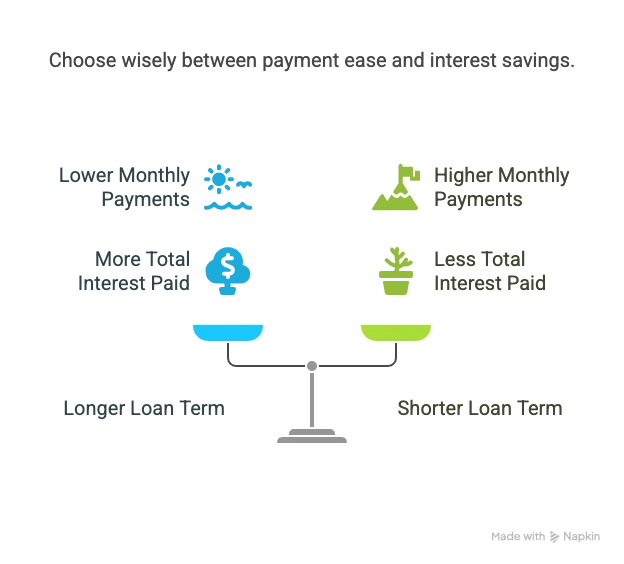

Compare Loan Options: Generate schedules for a 15-year vs. a 30-year mortgage to see the massive difference in total interest paid.

Strategize Extra Payments: Identify a goal, like paying off your loan 5 years early, and use the schedule to see how much extra you need to pay each month to achieve it.

Visualize Your Progress: Seeing your loan balance decrease with each payment can be a huge motivator to stay on track or even accelerate your payoff plan.

What is the difference between amortization and depreciation?

People often confuse these two terms, but they refer to completely different financial concepts.

Amortization: Relates to a loan. It’s the process of paying off debt over time in equal installments.

Depreciation: Relates to an asset. It’s the accounting method of allocating the cost of a tangible asset (like a company vehicle or computer) over its useful life.

Next Steps & Other Tools

Now that you understand your loan’s payment structure, take the next step in managing your finances.

If you’re planning for a home loan, use our full Mortgage Calculator with PITI to estimate your complete monthly housing costs.

See exactly how much interest you can save by paying off your loan early with our Extra Payment Calculator.

If your interest rate seems high, see if refinancing could lower your payments with our Refinance Calculator.

Creator