Marriage Tax Calculator: Will You Pay a Penalty or Get a Bonus?

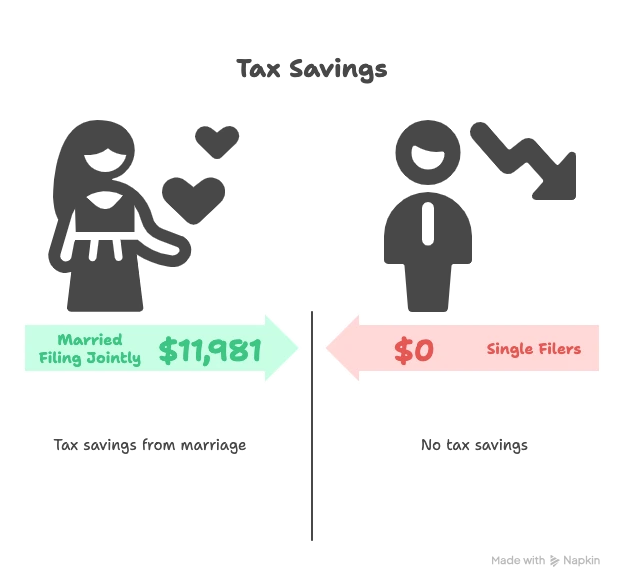

Getting married is a major life event, and it can significantly change your joint tax situation. Depending on your combined incomes, you could either pay less in taxes (a “marriage bonus”) or more (a “marriage penalty”).

Use our Marriage Tax Calculator to estimate the financial impact of filing your taxes jointly. It compares your total tax liability as two single individuals versus a married couple filing together.

Partner 1

Partner 2

Calculating...

Tax Comparison

How to Use Our Marriage Tax Calculator

Provide the following information for both you and your partner to see a side-by-side comparison. For the most accurate results, use your gross annual income.

-

Partner 1’s Gross Annual Income: Enter the total yearly income for the first partner, before any taxes or deductions (like 401(k) contributions) are taken out.

-

Partner 2’s Gross Annual Income: Enter the total yearly income for the second partner.

-

State of Residence: Select the state where you will live as a married couple. This is important for calculating state income taxes, which vary widely.

-

Number of Dependents: Enter the total number of qualifying children or other dependents you will claim together on your joint tax return.

Note: This calculator automatically applies the Standard Deduction, which over 90% of taxpayers use. The results will give you a strong estimate of the tax impact of getting married.

Understanding Your Results

The most valuable part of this calculator is the direct comparison. Your results will show whether getting married, from a purely tax perspective, is a financial benefit or a cost.

The table below breaks down your estimated taxes in both scenarios:

| Tax Component | Filing as Two Singles | Filing as Married Jointly | The Bottom Line: Penalty or Bonus |

| Federal Income Tax | $X,XXX |

$Y,YYY |

|

| State Income Tax | $X,XXX |

$Y,YYY |

|

| FICA Taxes | $X,XXX |

$Y,YYY |

|

| Total Estimated Tax | $A,AAA |

$B,BBB |

$Z,ZZZ |

The Bottom Line: Your Marriage Penalty or Bonus

This final number, $Z,ZZZ, tells you everything you need to know.

-

If the number is negative (e.g.,

-$1,500), you have a Marriage Bonus. You will pay an estimated $1,500 less in combined taxes by filing jointly than you would have as two single individuals. -

If the number is positive (e.g.,

+$2,100), you have a Marriage Penalty. You will pay an estimated $2,100 more in combined taxes by filing jointly.

This happens because the income tax brackets and standard deduction for the “Married Filing Jointly” status are not a perfect doubling of the “Single” filer status.

Frequently Asked Questions

Who is most likely to face a marriage penalty?

A marriage penalty most often affects couples where both partners are high earners with very similar incomes.

The reason is that as their two individual incomes are combined, more of their money can be pushed into higher tax brackets faster than it would have been if they were single. The structure of the tax brackets means that two high single incomes added together can exceed the top of a joint bracket, resulting in a higher total tax.

Concrete Example:

-

Partner 1 Income: $200,000

-

Partner 2 Income: $200,000

-

Result: This couple will likely face a significant marriage penalty because their combined $400,000 income is taxed less favorably under the joint brackets than their two separate $200,000 incomes would be under the single brackets.

Who is most likely to get a marriage bonus?

A marriage bonus is most common when there is a significant difference between the two partners’ incomes. This includes situations where one spouse earns most of the income or one spouse does not work outside the home.

The higher-earning spouse effectively “pulls” the lower-earning spouse’s income into their lower tax brackets. The couple gets to take advantage of the wider tax brackets and a much larger standard deduction that comes with filing jointly, resulting in a lower overall tax bill.

Concrete Example:

-

Partner 1 Income: $150,000

-

Partner 2 Income: $25,000

-

Result: This couple will almost certainly receive a marriage bonus. The $150,000 earner benefits from the wider tax brackets designed for two incomes, significantly lowering their tax liability compared to when they were a single filer.

To avoid a penalty, should we file as “Married Filing Separately”?

For the vast majority of couples, the answer is no. Filing separately is almost always worse than filing jointly, even if you face a marriage penalty.

The “Married Filing Separately” (MFS) status has its own set of tax brackets that are much less favorable. Furthermore, choosing MFS makes you ineligible for many valuable tax deductions and credits, including:

-

The Earned Income Tax Credit

-

Education credits like the American Opportunity Credit and Lifetime Learning Credit

-

The ability to deduct student loan interest

-

The ability to deduct IRA contributions (in most cases)

Our calculator compares your situation to filing as two Single individuals (your status before marriage), not to the MFS status.

How does having children affect the marriage penalty or bonus?

Having children and being able to claim tax credits like the Child Tax Credit ($2,000 per qualifying child) can significantly reduce or even eliminate a marriage penalty. The income thresholds for claiming these credits are much higher for couples filing jointly than for single filers. A couple that might have faced a small penalty could easily find themselves with a bonus once child-related credits are factored in.

What other financial steps should we take before or after getting married?

Understanding your tax situation is a great first step. Here are other key financial conversations to have:

-

Be Transparent About Debt: Discuss any student loans, credit card debt, or car loans you each have.

-

Share Your Credit Scores: Your credit history can impact your ability to get joint loans for a car or home in the future.

-

Create a Joint Budget: Decide how you will manage day-to-day expenses, pay bills, and save for shared goals.

-

Update Your Beneficiaries: Don’t forget to update the beneficiaries on your retirement accounts (401k, IRA) and life insurance policies.

Plan Your Financial Future Together

Now that you understand how marriage affects your taxes, you can take the next steps in building your financial life together.

-

See how your new combined income impacts how much house you can afford with our Home Affordability Calculator.

-

Map out your shared expenses and savings goals by creating a new household budget with our Budget Planner Calculator.

-

If you’re planning to have children, estimate the costs and see how it fits into your budget with our Cost of Raising a Child Calculator.

Creator