Rent vs. Buy Calculator: Which Is Cheaper for You?

Deciding whether to continue renting or buy a home is one of the biggest financial choices you’ll ever make. The right answer depends on your finances, your lifestyle, and how long you plan to stay in one place. Our Rent vs. Buy Calculator moves beyond simple monthly payments to analyze the full long-term costs and benefits of both options, helping you find the financial breakeven point.

Breakeven Point

--

It's cheaper to rent before this point, and cheaper to buy after.

Cost of Buying

$0

Cost of Renting

$0

Cumulative Net Cost: Rent vs. Buy

How to Use Our Rent vs. Buy Calculator

To get a clear comparison, you’ll need to input details for both scenarios. Be as realistic as possible with your estimates.

If You Buy a Home

Home Price: The purchase price of a comparable home you would consider buying.

Down Payment: The amount of cash you’d pay upfront. Enter a percentage or dollar amount.

Loan Term & Interest Rate (%): Typically a 30-year term. Check current mortgage rates for a realistic interest rate.

Property Tax (%): In the Houston area, property tax rates are around 2.5% – 3.5% of the home’s value annually, but vary by county and school district.

Homeowners Insurance: Your annual premium to insure the property.

Annual Maintenance & HOA: A crucial estimate. A good rule of thumb is 1% of the home’s value per year for maintenance. Add any known HOA fees.

Home Value Appreciation (%): The rate you expect home values to increase per year. A conservative, long-term average is 2-4%.

How Long You Plan to Stay: This is a critical factor for your breakeven analysis.

If You Continue to Rent

Current Monthly Rent: The monthly rent for a comparable property.

Annual Rent Increase (%): The rate you expect your rent to increase each year. A typical estimate is 2-5%.

Understanding Your Results: Finding the Breakeven Point

The most important result from this calculator is your breakeven point. This is the number of years it takes for the total costs of buying to become less than the total costs of renting. Before this point, renting is cheaper. After this point, buying becomes the more financially sound option.

(A line chart would be placed here, showing two lines: “Total Cost of Renting” and “Total Cost of Buying.” The buying line starts higher but has a gentler slope, eventually crossing below the rent line at the breakeven point.)

Why does this happen? It’s a tale of two financial paths:

Renting: You start with lower upfront costs, but your rent payment continuously rises over time and builds no long-term wealth.

Buying: You face high upfront costs (down payment, closing costs). However, your monthly mortgage payment is fixed, and a portion of it acts like a forced savings account by building home equity.

Let’s look at a comparison over 7 years for a $350,000 home in the Houston area:

| Metric | Buying a Home | Renting a Similar Home |

| Initial Upfront Cost | $27,500 (5% Down + Closing Costs) | $2,500 (Security Deposit) |

| Average Monthly Cost | $3,100 (PITI + Maintenance) | $2,750 (Rent, increases annually) |

| Total Housing Cost After 7 Yrs | ~$260,400 | ~$241,800 |

| Wealth Built After 7 Yrs | ~$125,000 (Equity + Appreciation) | $0 |

In this scenario, while you may have paid more out-of-pocket to own, you’ve also built significant wealth through equity. Renting, while cheaper in terms of cash flow, results in no asset ownership.

Frequently Asked Questions About Renting vs. Buying

What are the “hidden costs” of buying a home?

This is a critical part of the equation that our calculator helps you factor in. Beyond your mortgage payment (PITI), homeownership costs include:

Closing Costs: Typically 2-5% of the loan amount for fees like appraisals, title insurance, and lender charges.

Maintenance & Repairs: The 1% rule suggests budgeting 1% of your home’s value annually for things like a new water heater, roof repairs, or appliance failures.

HOA Fees: If you buy in a community with a homeowners association, these monthly or annual fees are mandatory.

Higher Utility Bills: You may pay more for utilities in a larger home compared to an apartment.

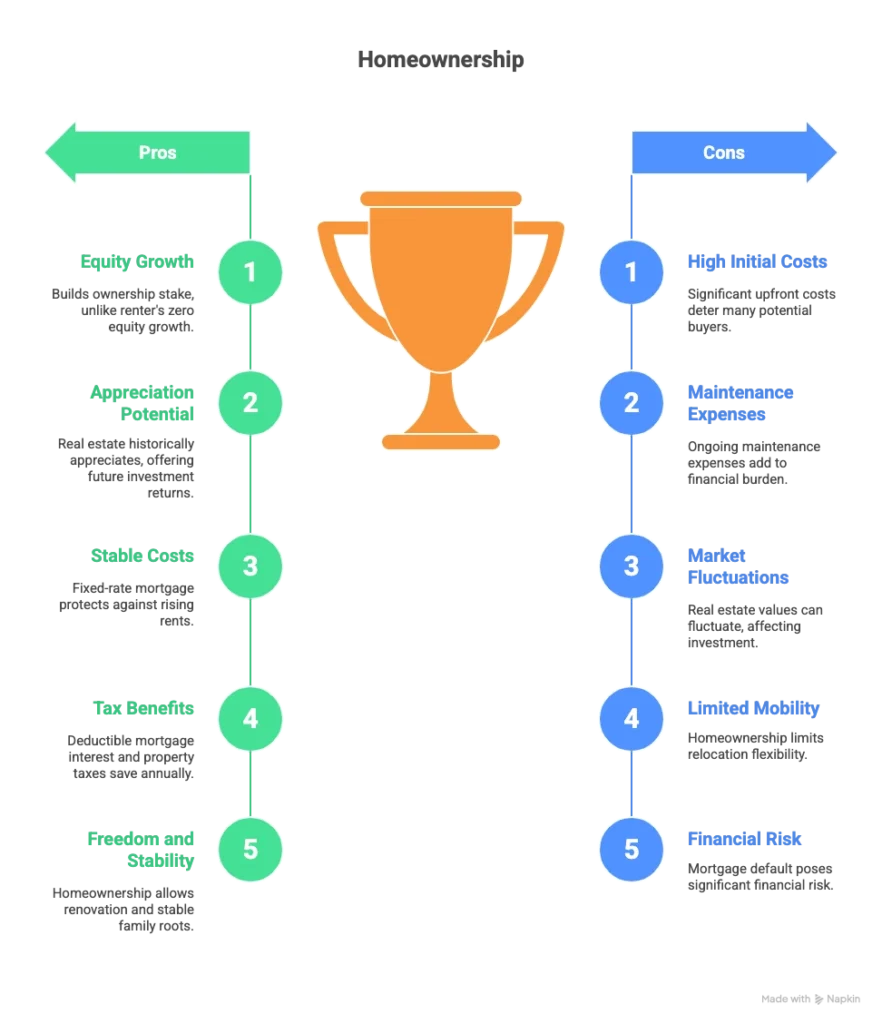

Beyond the numbers, what are the lifestyle benefits of each?

This decision isn’t purely financial. Your lifestyle and personal preferences matter just as much.

| Benefits of Renting | Benefits of Buying |

| Flexibility: Easy to move for a new job or to a new city. | Stability: Roots in a community for yourself and your family. |

| Predictable Costs: No surprise repair bills. | Pride of Ownership: A space that is truly yours. |

| Fewer Responsibilities: No yard work or maintenance. | Freedom to Customize: Paint, renovate, and decorate as you wish. |

| Lower Upfront Cost: Only need a security deposit and first month’s rent. | Building Equity: A valuable asset for your future. |

Think of equity as your ownership stake in the home. It’s the difference between what your home is worth and what you owe on your mortgage. You build equity in two ways:

Principal Payments: Every month, a portion of your mortgage payment pays down your loan balance, increasing your ownership.

Appreciation: As the value of your home increases over time, your equity grows along with it.

This equity can be a powerful tool for building long-term wealth.

Are there still tax benefits to owning a home in 2025?

Yes, but they are less common than they used to be. Homeowners can potentially deduct mortgage interest and property taxes (up to a $10,000 “SALT” cap). However, since the standard deduction was increased significantly in recent years, most taxpayers find it’s more beneficial to take the standard deduction rather than itemizing these housing-related expenses. It’s best to consult with a tax professional to see how your specific situation is affected.

Is now a bad time to buy a house in Houston? (July 2025)

As of mid-2025, the Houston housing market is navigating higher interest rates than those seen in the early 2020s. While this has cooled the frenzy, demand remains steady due to the area’s strong job growth.

Trying to “time the market” is often a losing game. A better question is, “Is now a good time for me to buy?” If you have a stable income, have saved for a down payment, and plan to stay in the Houston area for at least 5-7 years (past your breakeven point), then buying can still be a sound long-term financial decision, regardless of short-term market fluctuations.

What happens if I need to move before my breakeven point?

This is one of the biggest financial risks of buying a home. If you sell a house too soon, you may lose money. The transaction costs of selling—typically 6-10% of the sale price for agent commissions, closing costs, and repairs—can easily wipe out the small amount of equity you’ve built in the first few years. This calculator helps you see how long you need to stay to make the upfront costs of buying worthwhile.

Take the Next Step in Your Financial Journey

If the numbers suggest buying is the right path, see how much house you can realistically afford with our Home Affordability Calculator.

Ready to start planning for a down payment? Our Down Payment Calculator can help you explore different scenarios and set a savings goal.

If renting makes more sense right now, consider what you might do with the money you save. See how investing the difference could grow over time with our Compound Interest Calculator.

Creator