Real Estate Calculator: Estimate Your Total Cost of Ownership

Calculating the true monthly cost of a property is essential before making an offer in the current real estate market. Our complete real estate calculator helps you see beyond the listing price to estimate your total monthly payment, including taxes, insurance, and HOA fees.

Cash on Cash ROI

0.00%

Monthly Cash Flow

$0

Monthly Costs Breakdown

Investment Projection (10 Years)

How to Use Our Real Estate Calculator

Enter the details of a specific property to get a reliable estimate of your all-in monthly and upfront costs.

Home Price: The property’s listing price or the amount you plan to offer.

Down Payment: The cash you are paying upfront. You can enter this as a dollar amount (e.g.,

$60,000) or a percentage of the home price (e.g.,20%). A20%down payment typically helps you avoid PMI.Loan Term (in years): The length of your mortgage. As of July 22, 2025, the 30-year fixed-rate mortgage remains the most popular choice in the United States.

Interest Rate (%): The estimated annual interest rate for your mortgage. Check today’s average rates for the most accurate estimate.

Property Tax: The annual property tax for the specific home. You can enter this as a percentage of the home price (e.g.,

1.1%) or a specific annual dollar amount, often found in the online property listing details.Homeowners Insurance: The estimated annual premium to insure the property. If you don’t have a quote,

$1,800to$2,400per year is a common starting point, but this varies widely by location and home value.HOA Fees: If the property is part of a Homeowners Association (HOA), enter the monthly fee here. This is a common cost for condos, townhomes, and homes in planned communities and is critical for an accurate payment estimate.

Understanding Your Real Estate Payment

Our calculator provides two key results: your estimated Total Monthly Payment and your Total Upfront Costs.

Total Monthly Payment (PITI + HOA)

This is your estimated all-in cost per month for owning the property. It’s made up of several parts:

Principal: The portion of your payment that goes directly toward paying down your loan balance.

Interest: The cost of borrowing the money, paid to your lender.

Taxes: One-twelfth (

1/12) of the annual property tax bill. Your lender typically collects this in an escrow account and pays the bill for you.Insurance: One-twelfth (

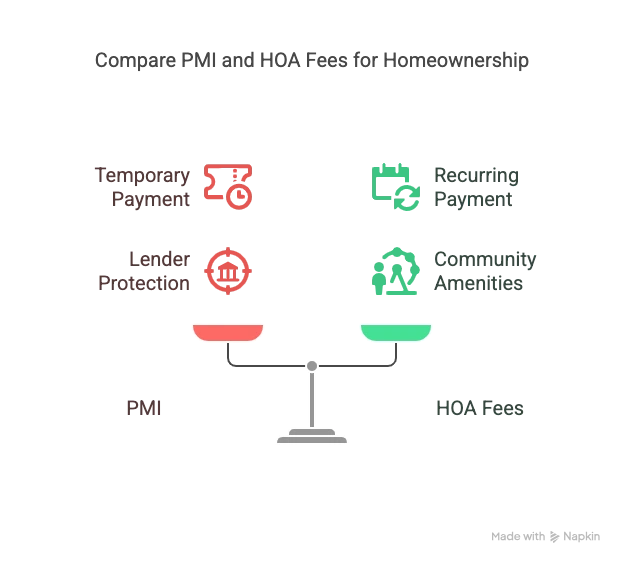

1/12) of your annual homeowners insurance premium, also typically held in escrow.HOA Fees: The monthly fee paid directly to the Homeowners Association for community maintenance and amenities.

PMI (if applicable): If your down payment is less than

20%, your payment will also include Private Mortgage Insurance.

(A pie chart visualization would be ideal here, showing the percentage breakdown of the total monthly payment.)

Total Upfront Costs

This is the estimated cash you will need on closing day. It includes:

Your Down Payment: The largest portion of your upfront costs.

Estimated Closing Costs: These are the fees for services required to finalize the loan and real estate transaction. They typically range from

2%to5%of the total loan amount.

Real Estate Buying: Frequently Asked Questions

What are closing costs and what do they include?

Closing costs are the collection of fees you pay to finalize a real estate transaction. They are separate from your down payment and are due on the closing day. While they vary by state, common closing costs include:

Loan Origination Fee: A fee charged by the lender for processing the loan.

Appraisal Fee: The cost to have a professional appraiser determine the home’s fair market value.

Title Insurance: Protects you and the lender from claims against the property’s title.

Attorney Fees: Fees for the real estate attorney who reviews documents and facilitates the closing.

Recording Fees: Fees paid to the local government to officially record the sale.

Are property taxes and homeowners insurance fixed for the life of the loan?

No, this is a critical point that many new homeowners miss. Both can change, which will alter your total monthly payment. Property taxes are reassessed by your local government periodically and can increase. Homeowners insurance premiums can be adjusted by your provider annually based on factors like claims history, inflation, and local weather risks. Your escrow payment will be adjusted accordingly, usually once a year.

What exactly do HOA fees cover?

HOA fees cover the maintenance, repair, and administration of a community’s shared spaces and amenities. Depending on the community, this can include landscaping, swimming pool and gym maintenance, security services, trash removal, snow removal, and insurance for common areas. It’s important to review the HOA’s budget before you buy to understand what is covered and if the association is financially healthy. Be aware that HOA fees can and often do increase over time.

Should I get a home inspection?

Absolutely. A home inspection is arguably the most important step you can take after your offer is accepted. An inspector will assess the home’s condition from the foundation to the roof, including plumbing, electrical, and HVAC systems, to uncover potentially serious and expensive hidden issues.

Concrete Example: Spending $500 on a professional home inspection might feel like just another fee. However, if that inspector discovers a significant roof leak that will cost $12,000 to repair, you have just saved yourself from a massive financial headache. This information gives you the power to negotiate with the seller for repairs or a price reduction, or to walk away from a bad investment entirely.

What is an escrow account and how does it work?

An escrow account is a special savings account managed by your mortgage lender. Each month, a portion of your total payment is deposited into this account to cover your estimated property taxes and homeowners insurance premiums. When these bills come due (usually once or twice a year), the lender pays them for you from the funds in your escrow account. This process protects the lender by ensuring that taxes and insurance are always paid on time, preventing tax liens or a lapse in coverage.

How do I make a competitive offer in today’s market?

In the competitive U.S. real estate market of 2025, a strong offer involves more than just the price. To make your offer stand out, consider:

A Strong Pre-Approval Letter: This shows the seller you are a serious and financially capable buyer.

A Higher Down Payment: A larger down payment can signal financial strength.

Flexibility: Being flexible on the closing date can be very appealing to a seller.

An Escalation Clause: An offer to increase your price by a certain amount if a higher bid comes in, up to a maximum cap.

Reducing Contingencies: You might offer a shorter inspection period. However, be extremely cautious about waiving the inspection contingency entirely, as this carries significant risk.

Next Steps & Other Tools

Calculating the payment is the first step. Now, put that number in context.

Before making an offer, double-check that this payment fits your overall budget with our [House Affordability Calculator].

Lenders will look closely at your finances. Calculate your qualifying ratio with our Debt-to-Income (DTI) Ratio Calculator.

Comparing this purchase to staying in your current rental? Analyze the long-term financial implications with our Rent vs. Buy Calculator.

Creator