(DTI) Debt-to-Income Ratio Calculator

Understanding your debt-to-income (DTI) ratio is essential when you’re preparing to apply for a major loan like a mortgage. This simple Debt-to-Income Ratio Calculator will show you your DTI in seconds, giving you the same insight a lender will see when evaluating your financial health.

Your DTI Ratios

How to Use Our Debt-to-Income Ratio Calculator

To get an accurate DTI ratio, you will need to provide your total income and a complete picture of your monthly debt payments.

Gross Monthly Income: Enter your total household income for one month, before taxes and other deductions are taken out. This includes wages, salaries, freelance income, bonuses, social security, and any other regular sources of income.

Total Monthly Debt Payments: Add up all your minimum required monthly debt payments. It is critical to include the right items.

Mortgage or rent payments

Minimum credit card payments (even if you pay the balance in full)

Auto loan payments

Student loan payments

Personal loan payments

Alimony or child support payments

Any other recurring loan payments

Important: Do NOT include utilities, groceries, cell phone bills, car insurance, or other day-to-day living expenses in this calculation.

Understanding Your Debt-to-Income Ratio

Your DTI is calculated with a simple formula: DTI=Gross Monthly IncomeTotal Monthly Debt. The result shows what percentage of your monthly income is allocated to debt payments. Lenders use this percentage as a primary indicator of your financial health and ability to take on new debt.

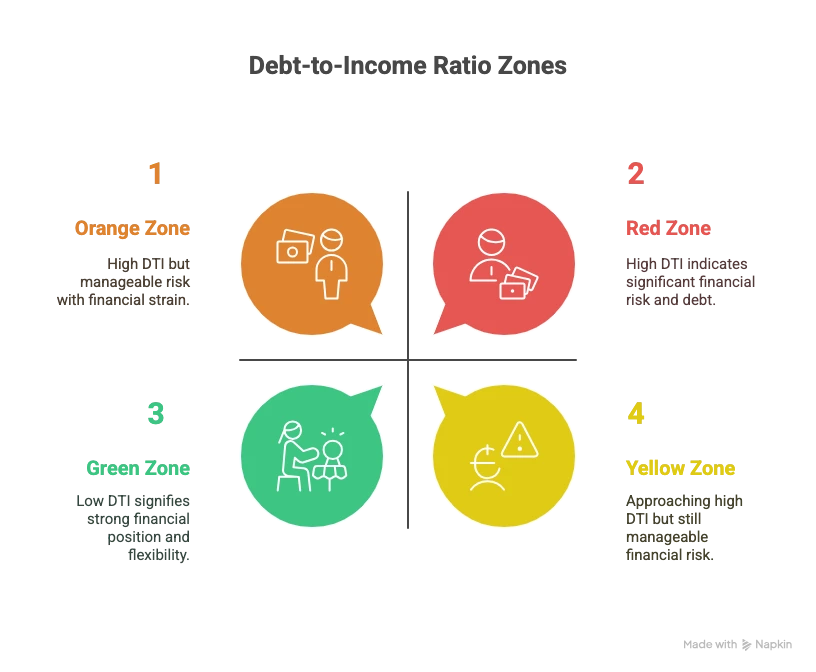

Here’s a breakdown of what your DTI ratio means to lenders.

| DTI Ratio | Lender’s View | Your Financial Standing |

| 36% or Less (Ideal) | You are seen as a low-risk borrower. You will likely qualify for the most loan options and the lowest interest rates. | Excellent. You have a healthy balance between debt and income, with plenty of room for other expenses, savings, and investments. |

| 37% to 43% (Manageable) | This is often the maximum DTI allowed for a conventional “qualified mortgage.” You can still get a loan, but your options may be more limited. | Your budget is likely tight. It’s a good idea to focus on paying down debt before taking on more. |

| 44% to 49% (High) | It will be challenging to get approved for a new loan. Some government-backed loans might be available, but options are scarce. | A significant portion of your income goes to debt, which can increase financial stress and risk. |

| 50% or More (Very High) | You are unlikely to be approved for a new mortgage or most other loans. Lenders see this DTI level as a high risk of default. | Urgent action is needed. Your financial situation is likely strained, and prioritizing debt reduction is crucial. |

Frequently Asked Questions About Debt-to-Income Ratio

What’s the difference between front-end and back-end DTI?

You may hear lenders mention two types of DTI.

Front-End DTI (or Housing Ratio): This only includes your housing-related costs (principal, interest, taxes, and insurance—PITI) divided by your gross monthly income. Lenders like to see this below

28%.Back-End DTI: This includes all of your monthly debt obligations (PITI + credit cards, auto loans, etc.) divided by your gross monthly income.

While both are considered, the back-end DTI is the most important number for loan qualification, and it is the number this calculator provides.

How can I lower my DTI ratio?

Lowering your DTI is one of the best ways to improve your financial health and borrowing power. There are two ways to do it:

Increase Your Income: This could involve asking for a raise, taking on more hours, or starting a side business. More income instantly lowers your DTI ratio.

Decrease Your Monthly Debts: This is the most common strategy. Focus on paying down debt balances, especially high-interest credit cards. Paying off a smaller loan completely (like a personal loan) eliminates its monthly payment from your DTI calculation entirely. Crucially, avoid taking on new debt (like a new car loan) right before applying for a mortgage.

Do I include my current rent payment when applying for a mortgage?

This is a great question. When a lender calculates your DTI for a mortgage application, they do not use your current rent. Instead, they replace your rent payment with the proposed new mortgage payment (PITI) for the home you want to buy. You can use our calculator today with your rent included to see where you stand, but the number will change during the mortgage process.

Can I still get a loan with a high DTI?

It is difficult, but not always impossible. Some government-backed loan programs, like FHA loans, are designed to help borrowers who may not meet conventional standards. An FHA loan may allow for a DTI ratio above 50% if the borrower has other compensating factors, such as a high credit score (e.g., above 620), a larger down payment, or significant cash reserves. However, taking on a mortgage with a very high DTI is risky and should be carefully considered.

Why don’t utilities, groceries, or insurance count towards my DTI?

DTI is a specific lending metric that measures your ability to manage debt obligations. It focuses on contractual payments for borrowed money and court-ordered payments. While lenders know you have other living expenses, and they do factor into your overall financial picture, they are not included in the official DTI formula used for qualification.

How quickly can I improve my DTI?

The timeline depends on your strategy.

Paying off a loan: As soon as you pay off a loan (e.g., a car loan), its monthly payment is removed from your DTI calculation. This can provide a significant improvement in just 30-60 days (after it’s updated on your credit report).

Paying down credit cards: Reducing balances lowers your minimum payments, providing a gradual improvement.

Increasing income: This can have an immediate impact as soon as your pay stubs reflect the higher earnings.

Concrete Example: Imagine your gross monthly income is $6,000 and your total monthly debts are $2,400, for a DTI of 40%. If you have a credit card with a $240 minimum payment, and you aggressively pay it down so the new minimum is $140, you’ve cut $100 from your monthly debt. Your new DTI would be $2,300 / $6,000 = 38.3%, potentially moving you into a better lending category.

Next Steps & Other Tools

Your DTI ratio is a roadmap for your financial journey. Use it to plan your next move.

Now that you know your DTI, see how it impacts your home buying budget with our House Affordability Calculator.

If your DTI is higher than you’d like, use our Debt Payoff Calculator to create a strategy for paying down your balances faster.

Ready to see what a monthly mortgage payment could look like? Estimate your potential costs with our comprehensive Mortgage Calculator with PITI.

Creator