Rent Calculator: Find Your Ideal Rental Affordability Budget

Finding a rental that fits your budget is the key to maintaining financial health and peace of mind. Our rent calculator uses a proven budgeting rule to help you determine a smart and affordable monthly rent based on your income.

How Much Rent Can You Afford?

Enter your income and debts to see a recommended rent budget. Results update instantly as you type.

Recommended Monthly Rent

$0

Conservative (25%)

$0

Recommended (30%)

$0

Aggressive (40%)

$0

Sample Monthly Budget Breakdown

How to Use Our Rent Calculator

This tool gives you a personalized rent recommendation with just two simple inputs.

-

Gross Monthly Income: Enter your total household income for one month, before any taxes or deductions are taken out. If you know your annual salary, simply divide it by 12 to get your gross monthly income.

-

Desired Rent-to-Income Ratio (%): This is the percentage of your pre-tax income you plan to spend on rent. The standard financial recommendation is

30%, which is the default for this calculator. You can adjust this slider based on your personal budget, debt levels, and financial goals.

Understanding Your Results: The 30% Rule

The calculator provides you with a recommended maximum monthly rent. This figure is based on a long-standing financial guideline known as the 30% Rule.

The 30% rule suggests that you should spend no more than 30% of your gross monthly income on housing costs. Adhering to this guideline helps ensure that you have enough money left over for all your other expenses (like transportation, food, and utilities), as well as for saving and paying down debt. Going too far above this percentage can lead to financial stress and make it difficult to achieve other goals.

Rent Affordability at Different Income Levels

This table shows what the 30% rule looks like in practice at various income levels.

| Gross Monthly Income | Recommended Max Rent (30%) | Remaining for Other Expenses |

$3,500 |

$1,050 |

$2,450 |

$4,500 |

$1,350 |

$3,150 |

$6,000 |

$1,800 |

$4,200 |

$7,500 |

$2,250 |

$5,250 |

$9,000 |

$2,700 |

$6,300 |

Frequently Asked Questions

Do landlords really use the 30% rule?

Yes, they do, but they often express it differently. Many landlords and property management companies require that an applicant’s gross monthly income is at least three times (3x) the monthly rent. This is just the other side of the 30% rule coin (1 / 3 = 33.3%). It’s a quick way for them to verify that a potential tenant can comfortably afford the rent.

Concrete Example: If you’re applying for an apartment in Houston, Texas that costs $1,600 per month, the landlord will likely require you to show proof of a gross monthly income of at least $4,800 ($1,600 * 3).

What other costs should I budget for besides rent?

Your monthly rent is your biggest housing expense, but it’s not the only one. First-time renters are often surprised by these additional costs:

-

Security Deposit: A refundable deposit to cover potential damages. This is typically equal to one month’s rent.

-

Upfront Costs: Some landlords require the first and last month’s rent upon signing the lease.

-

Utilities: Electricity, water/sewer, natural gas, and trash service. Ask the landlord which utilities are included in the rent, if any.

-

Internet/Cable: These services are almost always a separate cost.

-

Application Fees: A non-refundable fee (

$25–$75per applicant) to cover the cost of a background and credit check. -

Renter’s Insurance: A low-cost policy that protects your belongings. Many landlords now require it.

-

Moving Costs: The expense of hiring a truck or movers.

Should I ever spend more than 30% of my income on rent?

While the 30% rule is an excellent guideline, it’s not absolute. In some high-cost-of-living (HCOL) cities, it may be difficult to find a suitable apartment for less than 30% of your income. You might decide to go up to 35% or even 40% if you are in a very competitive market, have no debt, and are willing to cut back significantly on other discretionary spending (like dining out or travel). Conversely, if you have significant student loan debt or are aggressively saving for a down payment, you might aim for a lower ratio, like 25%.

What’s the difference between “gross income” and “net income”?

This is a critical distinction for budgeting.

-

Gross Income: Your total earnings before any taxes, health insurance premiums, or retirement contributions are deducted. This is the number landlords use for their

3xrent rule. -

Net Income: Your “take-home pay.” This is the actual amount of money that hits your bank account after all deductions.

While you should use your gross income for this calculator and rental applications, you should always build your detailed personal budget using your net income, as that’s the money you actually have available to spend.

What is renter’s insurance and is it worth it?

Renter’s insurance is a type of property insurance that protects your personal belongings inside a rental property. It covers losses from events like fire, theft, or water damage. It also provides liability coverage in case someone is injured in your apartment and sues you. Policies are very affordable, often costing only $15-$30 per month. Given that a landlord’s insurance only covers the building itself—not your possessions—renter’s insurance is absolutely worth it for your financial protection and peace of mind.

How can I improve my chances of getting approved for an apartment?

In a competitive rental market like Houston, having your documents in order is key. To make a great impression, come prepared with:

-

Proof of income (recent pay stubs or an offer letter)

-

A copy of your government-issued ID

-

A completed rental application

-

Money for the application fee

-

Reference letters from previous landlords, if possible

If you have a low income or poor credit, consider getting a roommate to combine incomes or asking a trusted person to be a co-signer on your lease.

Next Steps & Other Tools

Now that you have your rental budget, you can think about your other financial goals.

-

Planning to buy a home someday? See how your savings could translate to homeownership with our House Affordability Calculator.

-

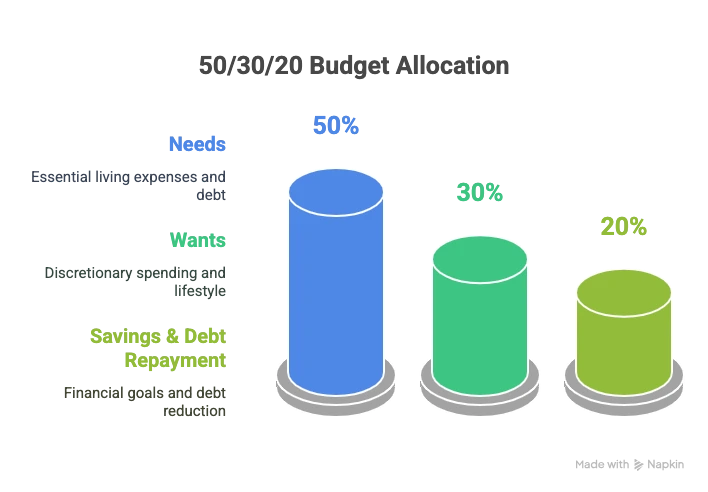

Want to see how your rent payment fits into a larger financial plan? Organize your spending with our 50/30/20 Budget Calculator.

-

Are you saving up for a down payment while you rent? Track your progress with our Down Payment Savings Goal Calculator.

Creator